How Employees Can Avoid Payday Loans with EWA

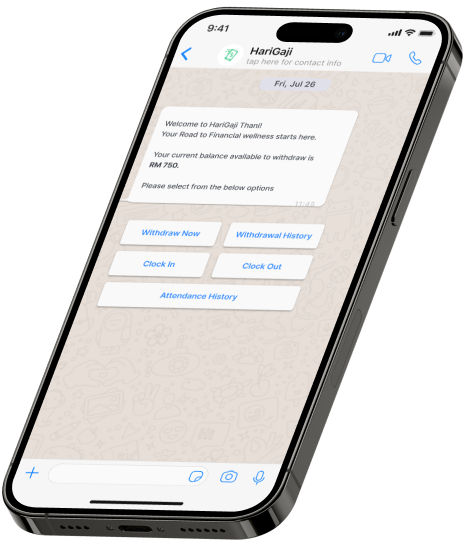

Access to earned wages before the payday is made possible by EWA, which is also known as Earned Wage Access. What this implies is that some amount from their earned salary can be withdrawn if an employee finds themselves in urgent need of money instead of having to wait for their payday. This ensures that the employees avoid payday loans, which are expensive and involve heavy interest rates. EWA, however, ensures that employees do not have to incur any additional fees to get their money. It enables the employees to gain better control over their finances, cater for unplanned spending, and get into debt. Instead of having to stress about managing money if a need arises, then early wage access is an easy and effective solution.

What are Payday Loans, and Why are They Problematic?

A payday loan is a short-term loan usually wanted by a customer due to some sudden expense that requires cash. A loan of this kind is expected to be repaid within the next payday of the borrower, hence the name ‘payday loan’. Even though payday loans provide quick cash exactly when one is in need of it, they also carry great risks and lack transparency. The main flaw in payday loans is the kind of interest rates that are charged on them. Some payday lenders charge annual percentage rates (APR) that are over 400%, ranking them among the highest cost of credit available. This high expense leads to excessive difficulties for borrowers to repay the entire loan without availing a second loan to offset the initial one.

This and other predatory lending practices can be understood as part of a cycle that leads to dire financial circumstances. Loan officials levying charges on borrowers who fail to return their loans on time adds to the borrowed sum, which provides them with a higher amount of earnings. This means that this cycle of borrowing can severely impoverish an individual. The income deprived and those who have unfavorable credit histories are targeted by payday lenders, who wield an unfavorable advantage by ensuring that these people are unable to secure their business loans, which prevents them from catering to the mainstream market. Therefore, payday loans are highly considered a bad form of finance, as they tend to destabilize an individual financially in the long term.

How EWA Helps Employees Avoid Payday Loans

Earned Wage Access (EWA) helps employees avoid payday loans by allowing them to access wages they’ve already earned before their scheduled payday. This provides a flexible solution for those facing unexpected expenses, eliminating the need to rely on high-interest payday loans. Unlike payday loans, which often come with steep fees and debt traps, EWA offers a more affordable and sustainable option, helping employees maintain financial stability.

By accessing their earnings early, employees can meet their immediate financial needs without falling into the cycle of borrowing and repaying payday loans. Companies offering payroll advance services as part of employee financial wellness programs help workers manage financial stress in employees effectively.

How Employees Can Use EWA Wisely

Earned Wage Access can be a helpful financial tool when used responsibly. Here are some tips for employees to use early wage access wisely:

- Access Only What You Need: Withdraw only the amount necessary to cover urgent expenses. Overusing on-demand pay can lead to cash flow problems when payday arrives.

- Plan for Emergencies: Payroll advance services should be reserved for unexpected, large expenses like medical bills or car repairs, not for everyday purchases. This helps avoid misuse of the service.

- Create a Monthly Budget: Keep track of your income and expenses to plan ahead. A budget can help prevent the need to rely on EWA regularly.

- Prioritize Saving: Build an emergency fund so you’re less dependent on Earned Wage Access for unexpected expenses. This promotes long-term financial stability.

- Avoid Frequent Withdrawals: While EWA is convenient, using it too often can disrupt your financial planning. Treat it as a backup option, not a regular habit.

Conclusion: A Better Financial Future with EWA

Earned Wage Access (EWA) offers a powerful solution for employees seeking more control over their finances. By allowing workers to access wages they’ve already earned before payday, EWA helps them avoid payday loans, which can lead to highinterest debt cycles. Companies like HariGaji provide payroll advance services and ondemand pay solutions that offer financial flexibility and peace of mind. When used wisely, EWA can help employees reduce financial stress in employees. However, it’s important to use this tool responsibly by only accessing what’s necessary, planning for emergencies, creating a budget, and building savings for long-term security. By treating EWA as a safety net, employees can avoid disrupting their financial planning. In the long run, Earned Wage Access can be a key component of a healthier financial future, empowering employees to make better financial decisions and achieve greater financial stability without relying on costly credit options.