Managing payroll efficiently is crucial for businesses of all sizes. With numerous payroll software options available in Malaysia, selecting the right one can be challenging. A well-designed payroll management system ensures timely salary disbursement, compliance with local tax laws, and seamless employee benefits administration. In this guide, we’ll help you choose the best payroll software for your business needs.

Understanding Your Payroll Needs

Before selecting payroll software, assess your business’s payroll management requirements. Consider factors like the number of employees, frequency of payroll processing, compliance with Malaysia’s labor laws, and integration with other business tools. A robust payroll software should provide real time payroll processing to ensure accurate and timely payments. It should also offer instant wage access and integrate with payday advance apps, allowing employees greater financial flexibility.

A payroll system should be able to handle salary calculations, bonuses, overtime, and deductions automatically. This not only saves time but also ensures compliance with local labor laws. Additionally, if your business operates in multiple locations across Malaysia, it’s essential to have a payroll software solution that supports multi-branch payroll processing.

Compliance with Malaysian Regulations

Payroll compliance is one of the most critical factors when selecting payroll software. Businesses in Malaysia must adhere to various labor laws, such as EPF (Employees Provident Fund), SOCSO (Social Security Organization), EIS (Employment Insurance System), and PCB (Potongan Cukai Bulanan or Monthly Tax Deduction). Failure to comply with these regulations can result in fines and legal issues. The right payroll management system should automate these deductions and generate compliance reports to ensure your business remains within legal boundaries.

Another critical aspect of compliance is data security. Since payroll management involves sensitive employee information, businesses must ensure that their payroll software is equipped with advanced security measures like encryption and access control. Cloud-based payroll software also offers secure backups, preventing data loss in case of technical failures.

Automation and Seamless Integration

One of the primary reasons businesses invest in payroll software is to automate routine tasks. Payroll management should eliminate manual calculations and provide an error-free payroll processing experience. Look for a system that integrates with your HR and accounting software to streamline processes and improve accuracy.

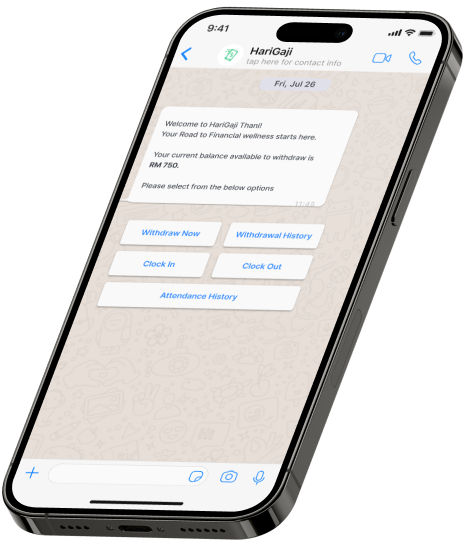

With the growing trend of instant wage access and payday advance apps, companies must ensure their payroll software supports these features. Providing employees with financial flexibility improves job satisfaction, reduces financial stress, and enhances overall productivity. Real-time payroll updates ensure businesses have better financial control, allowing employers to track expenses, salary payouts, and tax deductions accurately.

Integration with attendance and leave management systems also plays a significant role in payroll efficiency. A system that connects seamlessly with time-tracking tools ensures that salary calculations are based on accurate working hours, overtime, and paid leaves.

Scalability, Security, and Employee Benefits

As businesses grow, payroll management needs become more complex. Whether you have ten employees or a thousand, your payroll software should scale with your business. Cloud-based payroll software allows businesses to manage payroll operations from anywhere while maintaining high security and data integrity.

In addition to basic payroll processing, companies should consider providing employee benefits like payday advance apps and instant wage access. These features help employees access a portion of their earned wages before payday, reducing financial stress and improving retention rates.

Data security is another critical factor when choosing payroll software. A reliable payroll management system should have encryption, multi-factor authentication, and role-based access control to prevent unauthorized access. Companies should also ensure their payroll software provider complies with Malaysia’s Personal Data Protection Act (PDPA) to safeguard employee information.

Choosing the Best Payroll Software for Your Business

Selecting the right payroll software requires evaluating multiple factors such as ease of use, compliance, automation, and integration capabilities. Payroll management software that offers real-time payroll updates, instant wage access, and payday advance apps can enhance financial stability for employees and streamline business operations.

Customer support is also crucial when selecting a payroll software provider. A good software provider should offer reliable customer service, regular software updates, and a dedicated support team to resolve payroll-related issues quickly.

Investing in a comprehensive payroll management solution ensures businesses remain compliant with Malaysian labor laws while improving operational efficiency. The right payroll software can automate payroll calculations, provide real-time payroll insights, and support employee financial wellness through features like instant wage access and payday advance apps.

If you’re looking for a powerful payroll software solution that meets all these criteria, explore HariGaji Company’s top payroll software options in Malaysia today and take your business to the next level!