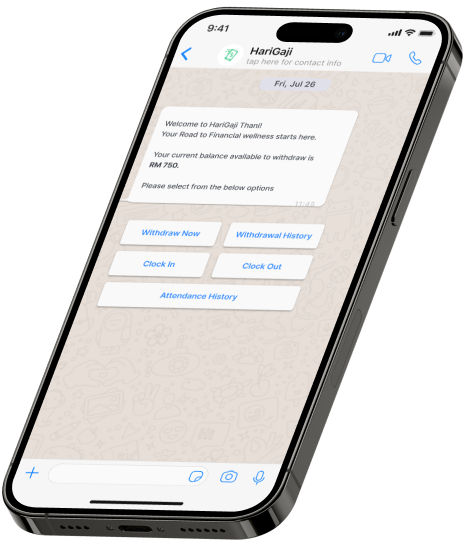

In the fast-paced retail industry, employee productivity plays a critical role in delivering exceptional customer service and driving sales. However, many retailers overlook a key factor influencing productivity—financial wellness. Retail employees often face unique financial challenges, from low wages to inconsistent schedules, making it difficult to manage their finances effectively. Wage advances and platforms like HariGaji, offering Earned Wage Access (EWA), are stepping in to bridge this gap, enhancing financial wellness and, in turn, improving workplace productivity.

What is Financial Wellness and Why Does It Matter in Retail?

Financial wellness goes beyond just having a steady income. It refers to an individual’s ability to manage their financial life effectively—covering everything from budgeting and saving to handling unexpected expenses without stress. In the retail sector, where employees often live paycheck to paycheck, payroll flexibility is directly tied to their performance at work.

A financially stressed employee may experience:

- Reduced focus and concentration, impacting their ability to engage with customers effectively.

- Increased absenteeism due to dealing with financial crises or seeking side jobs to make ends meet.

- Lower morale and job satisfaction, leading to higher turnover rates and reduced team cohesion.

The Financial Challenges Retail Employees Face

Retail workers encounter several financial hurdles that affect their overall well-being and productivity:

- Inconsistent Work Hours – Many retail employees are part-time or work irregular shifts, leading to unpredictable income.

- Limited Access to Benefits – Unlike full-time corporate employees, many retail workers don’t have access to benefits like paid leave, health insurance, or financial planning resources.

- Living Paycheck to Paycheck – Low hourly wages mean even a minor unexpected expense, like a car repair or medical bill, can cause significant financial strain.

- High Turnover Rates – Financial instability often pushes employees to frequently change jobs, looking for better-paying opportunities.

These challenges highlight the importance of Wage Advances and financial wellness programs tailored to the retail workforce.

How Earned Wage Access Enhances Financial Wellness

Earned Wage Access (EWA) solutions like HariGaji offer a simple yet effective way to improve employees’ financial health. By allowing employees to access a portion of their earned wages before the scheduled payday, payroll flexibility provides much-needed flexibility and financial control.

Here’s how it benefits retail employees:

- Immediate Access to Funds – Employees can withdraw their earnings to cover urgent expenses, avoiding high-interest payday loans or credit card debt.

- Better Budget Management – With more control over when they receive their wages, employees can better plan their spending and savings.

- Reduced Financial Stress – Knowing they have access to their earnings when needed alleviates financial anxiety, leading to improved mental health.

The Connection Between Financial Wellness and Productivity

Financially stressed employees are more likely to be distracted, disengaged, and less productive. Research shows that financial stress can reduce employee productivity by up to 15%. In a retail environment, where customer interactions are frequent and fast-paced, this drop in productivity can significantly impact sales and customer satisfaction.

- Improved Focus and Engagement – When employees aren’t worried about how they’ll pay their next bill, they can focus on their tasks, engage with customers more effectively, and contribute to a positive work environment.

- Higher Job Satisfaction and Morale – Providing employees with tools to manage their financial well-being shows that the company values their welfare. This increases job satisfaction and fosters loyalty, reducing turnover rates.

- Fewer Absences and Tardiness – Early wage access ensures employees have the flexibility to manage urgent financial matters without missing work, resulting in more consistent staffing and smoother operations.

- Enhanced Customer Service – In retail, happy employees lead to happy customers. Financially secure employees are more likely to provide excellent customer service, directly impacting the company’s bottom line.

Real-World Example: Financial Wellness in Action

A major retail chain in Southeast Asia partnered with HariGaji to introduce Earned Wage Access for their employees. Within just a few months, the company noticed significant improvements:

- 20% increase in employee productivity, as staff reported feeling more focused and less stressed.

- 15% decrease in absenteeism, as financial emergencies were managed without missing work.

- Higher customer satisfaction scores, attributed to more engaged and happy employees.

Employees shared that having control over their wages gave them a sense of financial freedom, allowing them to handle unexpected expenses without resorting to payday loans or credit cards.

Why Retailers Should Invest in Financial Wellness Programs

Investing in financial wellness isn’t just about supporting employees it’s a smart business strategy. Retailers who implement programs like EWA can benefit from:

- Lower turnover rates, saving costs associated with hiring and training new employees.

- Increased employee loyalty, leading to a more experienced and efficient workforce.

- Enhanced company reputation, attracting top talent and positioning the brand as an employer of choice.

By integrating HariGaji’s Earned Wage Access into their payroll systems, retailers can create a more supportive work environment that prioritizes employee well-being, ultimately leading to better business outcomes.

Conclusion: The Future of Retail is Financially Empowered

Financial wellness is no longer a luxury it’s a necessity in the modern retail landscape. Platforms like HariGaji are leading the way by providing flexible pay solutions that address the unique financial challenges faced by retail workers. By prioritizing financial wellness, retailers can create a more productive, engaged, and loyal workforce, setting the stage for long-term success in Malaysia and beyond.