Introduction

The level of productivity among employees is extremely important in a business organization’s operations. However, financial stress is a major barrier to the performance of employees that is often ignored. Research shows that around 63% of Americans are struggling by living from paycheck to paycheck, resulting in stress and lack of concentration in the workplace. This is where earned wage access (EWA) and financial wellness programs come in.

EWA programs allow workers to access the wages they have earned, hence improving their financial stability, which allows them to focus on work. In this blog, we will discuss how financial wellness relates to productivity, how earned wage access benefits aid in achieving financial wellness, and how to implement these techniques efficiently.

The Connection Between Financial Wellness and Employee Productivity

Understanding Financial Wellness Programs

Employers offer financial wellness programs to their employees in a bid to help them manage their finances. Debt management, saving schemes, and even budgeting classes can be a part of such programs. The aim of these programs is to tackle these issues and hence the stress levels of employees and promote a healthier and more productive workforce.

Why Financial Wellness is Crucial for Productivity There is a high correlation of financial stress to workplace absenteeism and low levels of workplace engagement. In a survey conducted by PWC, 57% of the participants reported that financialrelated problems prevent them from being productive at work. Employees working under financial constraints tend to procrastinate, make errors, and get exhausted much more easily. Such issues are directly dealt with through the provision of financial resources, including EWA solutions for productivity.

Earned Wage Access (EWA): A Revolutionary Solution

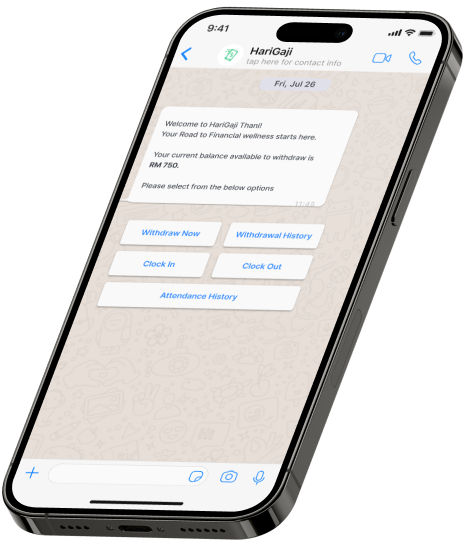

What is earned wage access?

Earned Wage Access (EWA) allows employees to access a portion of their earned wages before payday, providing financial flexibility, reducing reliance on loans, and enhancing overall financial wellbeing.

How EWA Supports Financial Stability

Through earned wage access benefits, many workers do not have to resort to payday loans that usually hold the workers in debt bondage. The workers get instant access to their earned wages, which they can use to take care of emergencies like paying medical bills, repairing cars, paying utility bills, etc. Such a reasonable level of financial security means that stress is reduced, allowing employees to execute their duties.

Benefits of EWA for Employers and Employees

For Employers

- Increased Retention: Employees who are supported through wages are less likely to switch jobs, meaning that turnover rates that are costly will not be incurred.

- Reduced Workplace Distractions: Employees’ worrying about their financial situation may have a negative impact on their productivity at work.

- Enhanced Reputation: Earned Wage Access benefits have the effect of changing the employers’ image to be great, which will attract great workers.

For Employees

- Reduced Financial Anxiety: How EWA helps employees in lessthan-ideal situations not to wait for the end of the month to get their pay.

- Improved Financial Management: Employees will in turn plan their payments better with EWA programs so that they do not incur costs like overdraft costs.

EWA as a Tool to Reduce Workplace Distractions

Financial Stress as a Distraction

As reported in research conducted by the American Psychological Association, employees cite financial problems as their primary stressor. This stress can often be observed in terms of reduced attention, decreased motivation, and increased absenteeism.

Focused and Productive Workforce

EWA solutions for productivity allow employees to settle their bills when they become due, which mitigates fears about such bills or other unforeseen obligations. Thus, organizations that incorporate EWA programs experience much better productivity and dedication amongst employees. For example, a retail chain registered a 25% improvement in productivity after earned wage access benefits initiatives were introduced in the organization.

How to Implement Financial Wellness Programs with EWA

Steps for Introducing EWA

- Partner with a Reliable Provider: Research and select an EWA program provider that aligns with your organization’s values and workforce needs.

- Develop Policies: Establish clear guidelines on how employees can use Earned Wage Access benefits responsibly.

- Communicate Effectively: Educate employees about EWA programs through workshops, webinars, and Q&A sessions.

Best Practices for Financial Wellness Programs

- Combine EWA solutions for productivity with other initiatives, such as financial literacy courses and retirement planning tools.

- Monitor program success through employee feedback and productivity metrics to make necessary adjustments.

Addressing Concerns About EWA

Common Misconceptions

- EWA Encourages Overspending”: In reality, EWA programs empower employees to manage emergencies without falling into debt.

- It’s Costly for Employers”: Many providers offer scalable solutions, ensuring affordability for businesses of all sizes.

Ensuring Responsible Usage

To prevent misuse, employers can integrate Earned Wage Access benefits with financial literacy programs that teach budgeting and savings strategies. Additionally, tracking usage trends helps identify areas for improvement.

The Future of Financial Wellness in the Workplace

Financial wellness is increasingly recognized as a cornerstone of employee well-being. Trends show a growing demand for EWA programsand similar benefits, especially among younger workers who prioritize flexibility and financial security. As technology evolves, EWA solutions for productivity are expected to integrate seamlessly with other financial tools, creating holistic solutions for workplace wellness.

Conclusion

Financial wellness programs, particularly Earned Wage Access (EWA), have emerged as vital tools for enhancing employee productivity. By addressing financial stress, How EWA helps employees focus on their work, improving overall performance and morale. Employers who embrace EWA programs not only support their teams but also gain a competitive edge in attracting and retaining talent.

Investing in Earned Wage Access benefits is more than a financial decision—it’s a step toward building a resilient, productive workforce.