Improved Recruitment and Retention Rates

The business advantages of EWA (Earned Wage Access) for SMEs are significant, offering valuable benefits for both employers and employees. By integrating EWA into payroll systems, small and medium-sized enterprises can provide their workers with financial flexibility and early access to earned wages. This solution enhances employee satisfaction and reduces financial stress, which in turn can decrease turnover rates. Furthermore, the business advantages of EWA for SMEs also extend to improving overall employee productivity and morale, making it an effective tool for retaining top talent. As SMEs look for ways to boost employee well-being and streamline payroll processes, EWA stands out as a powerful solution that meets both financial and operational goals.

Addressing Common Concerns About EWA

Cost of Implementation

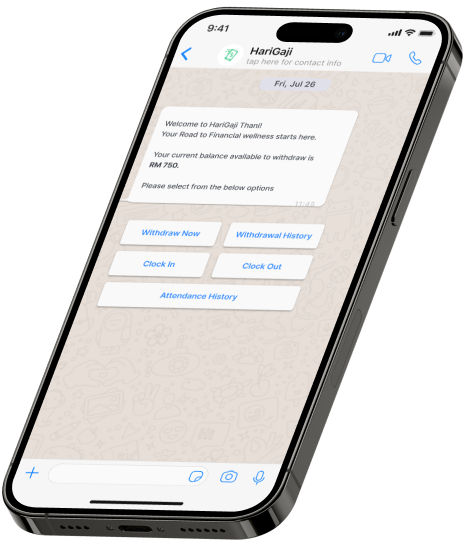

One cost that I believe is incorrectly characterized is the cost of executing EWA since this program is quite easy to scale on account of most EWA providers charging very tiny fees or none to employers depending on the model being used. Thus, some platforms provide optional fees to employees, which makes it also a good thing for the SMEs on the off chance that they are considering a transactional fee. Furthermore, observing how most organizations focus on issues of employee turnover and the need to increase productivity, the returns from these outweigh the initial costs of implementing the system without much trouble for the worker. As the best HariGaji Earned Wage Access provider, we ensure top-tier service delivery and flexible payroll solutions.

Security and Compliance

Another concern for SMEs is data security and legal compliance. In turn, safeguarding the remuneration of employees, some of the leading EWA providers may use sophisticated encryption techniques and follow global statutes like the GDPR and CCPA. For compliance, EWA does not count as a loan; it is access to your earned wages. It is a clear explanation to SMEs who wish to provide EWA that they will not have a legal issue. This reinforces the benefits of EWA for businesses and underscores our role as the best HariGaji Earned Wage Access provider.

Steps for SMEs to Implement Earned Wage Access

Research and Choose the Right Provider

Selecting the right EWA provider is crucial for successful implementation. SMEs should look for platforms that offer:

- Seamless integration with existing payroll systems.

- Transparent fee structures.

- Robust customer support.

- Positive user reviews from businesses in similar industries. Choosing the best HariGaji Earned Wage Access provider can enhance flexible payroll solutions and improve employee financial wellness.

Training and Employee Communication

Introducing a new benefit requires clear communication and training. SMEs should:

- Educate employees about how EWA works and its benefits.

- Address common concerns, such as transaction fees and potential impacts on payroll.

- Provide ongoing support to ensure employees can use the system confidently, promoting employee financial wellness.

Case Studies: SMEs Benefiting from EWA

Case Study 1: Retail Sector

A mid-sized retail chain implemented EWA to address high turnover rates among frontline staff. Within six months, employee turnover dropped by 25%, and productivity increased by 15%. Workers reported feeling less financial stress, leading to better job satisfaction and improving employee satisfaction significantly.

Case Study 2: Hospitality Sector

A small hotel chain adopted EWA as part of their benefits package. This move attracted experienced candidates who were considering roles at larger establishments. The hotel not only filled vacant positions faster but also reported a significant improvement in employee morale. The benefits of EWA for businesses were clearly visible in this scenario, enhancing flexible payroll solutions.

The Future of Earned Wage Access for SMEs

Trends in Employee Financial Benefits

The demand for flexible financial solutions is growing rapidly. Younger workers, especially Millennials and Gen Z, prioritize benefits like EWA over traditional perks. As these generations dominate the workforce, offering EWA will become less of a luxury and more of a necessity.

Predictions for EWA Adoption Rates

Industry analysts predict a sharp rise in EWA adoption among SMEs over the next decade. With advancements in technology and increasing awareness, EWA platforms will become more accessible, even for businesses with limited budgets.

Conclusion

Earned Wage Access is more than just a financial benefit—it’s a strategic investment in the well-being of employees and the success of SMEs. By addressing financial stress, improving retention rates, and enhancing operational efficiency, EWA empowers SMEs to compete in an increasingly competitive job market.

For SMEs looking to stay ahead, offering EWA is a smart move that aligns with employee expectations and fosters long-term business growth. Don’t wait—take the first step toward transforming your workplace with Earned Wage Access as provided by the best HariGaji Earned Wage Access provider.