Introduction

In the modern world, where business operates at an almost frantic pace, employee satisfaction levels are directly proportional to the success of any organizational institution. Earned Wage Access (EWA) acts as a solid link between financial health and job satisfaction, where employees feel cared for and appreciated. Those businesses that choose EWA not only appreciate their employees but prepare themselves as leaders in the innovative ways of engaging employees.

EWA provides measurable advantages to businesses, including better-established retention rates and increased productivity, to name a few. Employers wanting to embrace such an advanced strategy will allow themselves to be in a position where managing the difficulties posed by the recruitment market will be made easier, while at the same time ensuring a good, united, and happy workforce is the end result. With leading payroll management solutions, businesses can align better with modern employee expectations.

What Is Earned Wage Access (EWA)?

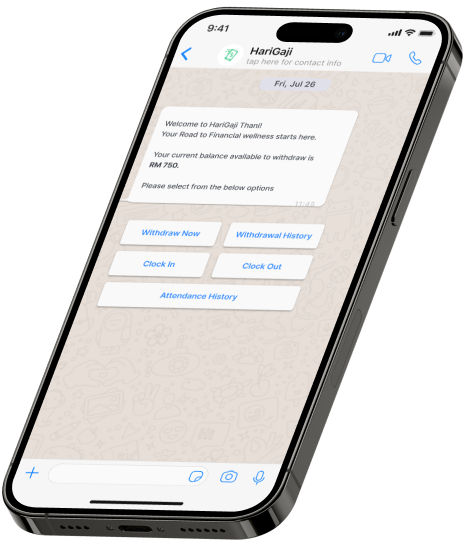

Earned Wage Access (EWA) is a new payroll concept that enables employees to withdraw part of their earned wages whenever they want instead of waiting for a certain period. This move away from the traditional model of payroll provides great ease and time value to the employees while assisting in the process for employers. Solutions like HariGaji, the best EWA provider, ensure smooth implementation.

Key Features of EWA

- Real-time access to earned wages.

- Seamless integration with existing payroll management solutions.

- Minimal administrative overhead for employers.

EWA vs. Traditional Payroll

As is typically the case in traditional systems of payroll, employees are required to wait several weeks for their checks, which in turn compels some employees to seek expensive out-of-term loans. This is what EWA benefits for businesses resolves, thus cutting down the financial stress and enhancing efficiency.

Financial Challenges in Payroll Management

Payroll is usually the biggest cost that a business has. Apart from the straightforward costs associated with workers’ pay, payroll processes touch upon:

- Administrative tasks, including time tracking and compliance.

- Payment processing fees.

- Cash flow disruptions due to fixed pay cycles.

These problems become accentuated to the companies having larger or geographically scattered employees, and they lead to an exponential increase in costs.

How EWA Reduces Payroll Management Costs

EWA simplifies payroll processes and reduces operational expenses in several ways:

1. Minimized Administrative Work

By automating wage disbursement, EWA reduces the administrative burden of traditional payroll processes. This frees up HR teams to focus on strategic initiatives rather than manual tasks.

2. Improved Cash Flow Management

With EWA, businesses can better manage cash flow, as they are not required to disburse full payroll amounts at once. Employees access only what they need, reducing strain on company finances.

3. Enhanced Employee Productivity

Financially stressed employees are more likely to be distracted or unproductive. EWA benefits for businesses by reducing this stress, resulting in higher engagement and productivity.

Employee Satisfaction and Cost Savings

Happy employees are productive employees, and EWA directly contributes to their financial well-being. When employees can access their earned wages on demand, they are less likely to: Miss work due to financial emergencies.

Seek alternative employment due to dissatisfaction with pay frequency.

Reduced Turnover Rates

Replacing an employee costs businesses significantly more than retaining one. EWA benefits for businesses by offering a financial safety net, boosting loyalty and satisfaction.

Improved Attendance

Financially secure employees are less likely to take unscheduled leaves, further reducing operational disruptions and associated costs.

EWA Technology: Streamlining Payroll Processes

The success of EWA lies in its seamless integration with payroll technologies. Advanced platforms ensure:

- Real-time tracking of employee earnings.

- Secure disbursement of wages.

- Full compliance with labor laws and regulations.

Best EWA Provider: HariGaji

Businesses seeking reliable payroll solutions can turn to HariGaji, known for offering the best EWA provider services in the industry.

EWA for SMEs and Large Corporations

Small Businesses:

For SMEs, EWA offers an affordable way to modernize payroll systems and compete with larger corporations for talent.

Large Enterprises:

For large-scale operations, especially those with dispersed workforces, EWA simplifies payroll logistics and enhances employee satisfaction on a broader scale.

Conclusion

Earned Wage Access (EWA) is revolutionizing payroll management by offering businesses a way to reduce costs while enhancing employee satisfaction. From minimizing administrative expenses to improving cash flow and reducing turnover,EWA benefits for businesses deliver a tangible return on investment for companies of all sizes.

As businesses strive to optimize operations without compromising on quality, payroll management solutions like EWA emerge as a practical, cost-effective solution. By partnering with the best EWA provider: HariGaji, organizations can ensure a financially secure and satisfied workforce, staying competitive in a challenging marketplace.