Earned Wage Access (EWA) helps workers get part of their pay before payday. Many workers in manufacturing have money problems. This can make them unhappy and miss work. With early wage access, they feel less stress and can focus better. It is easy for companies to set up earned wage access (EWA) with their payroll solutions. Flexible pay options like EWA also help workers avoid borrowing money at high costs through payday advance apps. When workers are happy, they stay longer and work harder. Employee benefits like EWA can save employers money by reducing the need to hire new people often. Salary advance options provided through EWA make life better for workers and help employers run their businesses more smoothly.

What Is EWA and Why Does It Matter in Manufacturing?

Manufacturing employers work in a tough industry. Keeping skilled workers and maintaining productivity are big challenges. Earned Wage Access (EWA) is an important employee benefit that helps both employers and workers.

EWA lets employees take out part of their earned money before payday. On-demand pay solutions address the financial problems many manufacturing workers face. This benefit makes life easier and helps them feel better about their job. Workers who are less stressed make fewer mistakes and work harder. Early wage access through EWA acts as a salary advance, enhancing employee financial well-being.

For an employer, easing the implementation of EWA enables them to recruit and retain a sufficient labor force. A lot of the blue-collar jobs characterized in the above dynamics have high turnover and attrition rates. This employee benefits service differentiates a company from its competitors. It also reduces the risk of workers skipping a shift because they are unable to borrow money through payday advance apps to address money emergencies. Offering early wage access as part of your employee benefits can significantly improve employee retention and loyalty.

Addressing Employee Financial Needs

Many workers in the manufacturing sector face financial challenges due to limited savings. A single missed payment can lead to late fees, credit score damage, and increased financial stress. While pay raises provide long-term relief, they often don’t address immediate monetary needs.

How EWA Helps Employees:

- Reduced Dependence on High-Interest Loans: Employees can avoid payday loans or payday advance apps, which often come with high fees.

- Easier Management of Daily Expenses: Access to earned wages through early wage access allows workers to cover small but essential costs like gas, groceries, or utility bills.

- Improved Focus at Work: Financial stability from salary advance options lowers stress levels, helping employees stay productive and engaged in their roles.

Competitive Advantage in Recruitment

Employers must distinguish themselves from other players in a competitive job market by offering something distinctive to draw and retain skilled employees. One such offering is early wage access. Earned Wage Access (EWA) allows employees to access their earned wages before the actual payday, serving as a valuable employee benefit. This feature enhances the image of your firm as modern and considerate of the employees and helps you to win over any competition in the market.

This practice is appealing to workers when they see this stated in job adverts. It indicates that the organization has an appreciation of their employees’ needs. Many workers have to deal with emergency expenses from time to time, and early wage access acts as a cushion for them. This engenders faith and confidence among them even before they have worked for your organization.

Earned Wage Access (EWA) will also be beneficial for your recruiting efforts as it tends to increase the rates of job applications. Job applicants are likely to opt for a company because of the regular employee benefits they are entitled to, rather than factors such as additional bonuses that are less useful. As a lower hiring cost is a goal of the applicant, EWA enhances the intended effect by fostering suitable candidates in the recruiting process. Additionally, integrating on-demand pay through EWA can make your recruitment strategies more effective and appealing to potential employees.

Improving Employee Retention

The hiring of new employees is costly, and retaining them is even more challenging. High employee turnover is a drain on resources and lowers team morale. Earned Wage Access (EWA) can be offered as a strategy for retention.

Earned Wage Access (EWA) helps build trust by ensuring that employees understand that their financial well-being is important. Salary advance options make employees appreciative of employers who assist them with unexpected expenses. Such a sense of care boosts employees’ willingness to stay.

Employees are less worried, which in turn improves their ability to focus as well as the productivity and performance of the employee, which is enhanced. When EWA is provided, employees feel good working at the company, turnover costs are reduced, and the stability of the team is maintained. Offering early wage access as part of your employee benefits ensures that employees remain loyal and engaged, reducing the high turnover rates common in manufacturing.

Boosting Morale and Productivity: Key Points

- Reduced Financial Worries: Employees are able to devote their attention to their job and make greater efforts in achieving their goals when there is no financial stress present. Improved Work Quality: A well-deserved break translates into less multitasking, resulting in fewer oversights and errors hence better overall output.

- Enhanced Team Collaboration: Pleasing employees through flexible pay options like EWA make them readily available for effective communication within the team and exchange ideas and help one another.

- Increased Productivity: An optimistic environment has an obvious effect on the outputs that the employees churn out.

- Supportive Environment: Facilities such as Earned Wage Access (EWA) and early wage access enable employees to see that the employer cares and appreciates them, which boosts their engagement and commitment.

Addressing the Skepticism

Employers are inclined to argue that the implementation of Earned Wage Access (EWA) will give rise to poor spending habits or add to the administrative burden of the organization, even though these concerns can be soothed by selecting an appropriate EWA provider.

Cowen & Company, for example, mentions that some EWA providers do impose controls, such as a limit on how much of their wages an employee can withdraw on a daily or pay period basis, thus ensuring that employees do not go overboard in spending their money while still allowing them to spend within a reasonable range as needed. Furthermore, such management systems are built in a way that no additional forms need to be completed and no manual reconciling is required as the system works alongside the existing payroll solutions.

Many employees have access to financial literacy tools and tips offered by EWA providers, which often go under-recognized. To guarantee that early wage access is a source of empowerment rather than a source of over-reliance, these resources aid employees in taking better control of their finances and using their funds more efficiently.

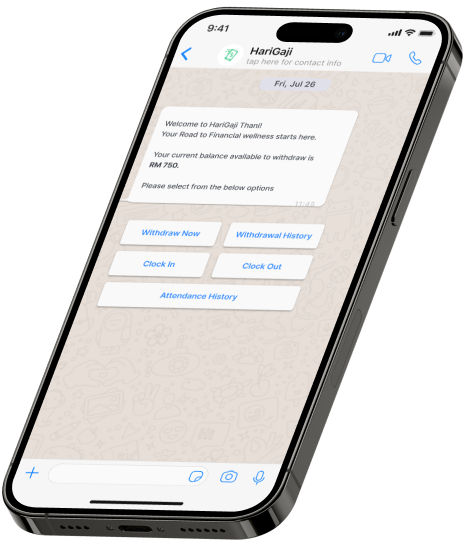

Setting Up EWA Successfully

- Research: Find a provider that fits your needs.

- Check Integration: Ensure the program syncs with your current payroll solutions.

- Explain Clearly: Tell employees how it works and any fees.

- Pilot First: Test in one department. See results.

- Feedback: Ask workers how they like it.

Track Numbers: Look at turnover, absences, and job satisfaction.