You can use unearned wages anytime before the determined payday using earned wage access. You do not have to wait until the regular days. Whenever you need a portion of your earnings, you make a request. It is useful for unforeseen bills and emergencies. It also relieves your anxiety. You will not incur exorbitant costs of a late payment or use of wages that are due. Employees tend to be in a better mood at work. People are punctual and absent less frequently. They are more secure in their jobs, and so they can concentrate on their work. EWA brings in adaptability. You can budget without the need to wait for a salary to come in. This strategy can enhance loyalty while minimizing turnover. However, Kema, a qualified financial expert, emphasizes that EWA needs to be controlled. You have to establish a certain limit and only spend some of them. Employers should offer advice on the proper way to manage their money. Many workers breathe easier, knowing that this service is available. EWA can be a great asset when there is a sufficient amount of resources available to manage finances properly.

The Value of Financial Peace of Mind

Financial peace of mind is essential for the financial well-being of an individual. The specific counting of people’s worries and concerns revolves around money, and their absence or presence influences many facets of daily life as illustrated below:

Physical Health: Stress can lead to sleep disorders, migraine, and even low immunity.

Mental Health: Concerns about the financial situation add fuel to anxiety and depression.

Job Performance: Employees who are more preoccupied with finances may not perform as effectively.

Relationships: Debt enables conflict around money and triggers anger with a spouse, relatives, and friends.

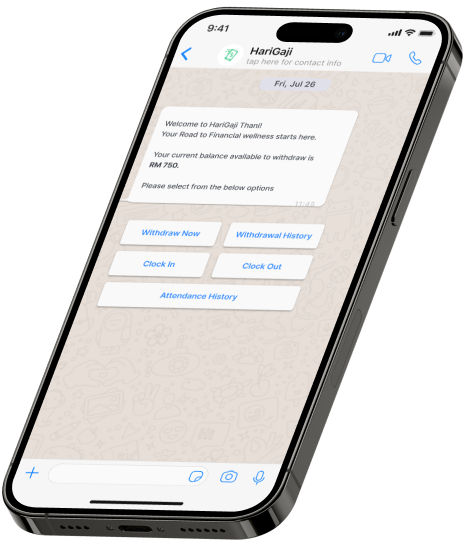

How EWA Works in Practice

With Earned Wage Access, employees can get part of their wages before payday. They use an app or platform to see how much they have earned so far. Next, they pick the amount they need and request a transfer. The money often arrives quickly in their bank account or on a prepaid card. On payday, the requested amount is deducted from their paycheck, plus any transaction fee if it applies. This process helps avoid costly overdraft fees or high-interest loans. EWA gives workers immediate financial relief, so they can handle urgent bills or daily expenses more easily. EWA is simple.

Key Benefits for Employees

EWA offers several advantages for employees:

- Immediate Access to Funds: Employees can get their earned wages when they need them, reducing the need for loans or credit cards.

- Reduced Financial Stress: By bridging the gap between paychecks, EWA helps employees avoid late fees, overdraft charges, or expensive payday loans.

- Greater Financial Control: Employees can better align their pay with their bills or handle sudden emergencies.

- Transparency: Most EWA providers clearly show how much has been earned, how much can be withdrawn, and any fees involved.

Key Benefits for Employers

EWA also provides benefits for employers:

- Boosted Employee Morale: Financially secure employees are usually more engaged, productive, and less likely to miss work.

- Lower Turnover: Offering EWA can encourage employees to stay with the company, improving retention rates.

- Enhanced Corporate Reputation: Showing a commitment to employee well-being improves your brand image.

- Minimal Cost: Many EWA providers charge employees directly or take a small fee from the employer, making it a low-cost benefit to offer. EWA vs. Traditional Payday Loans

EWA is different from payday loans in several key ways:

- Interest vs. Fees: Payday loans often have high interest rates, while EWA may only have a small flat fee or no fee at all.

- Repayment: EWA takes back the accessed wages directly from the next paycheck, avoiding a long repayment plan that can lead to debt.

- Safety: Since EWA is based on already-earned wages, there is less risk of falling into a debt cycle.

Long-Term Impacts on Financial Wellness

Using EWA can have lasting positive effects when combined with other financial wellness programs:

- Budgeting Assistance: Some EWA platforms offer budgeting tools to help employees manage their money better.

- Savings Boost: EWA can encourage employees to save part of each paycheck.

- Reduced Stress: Over time, employees learn to handle unexpected costs, improving their mental health and job satisfaction.

Why Choose EWA for Your Financial Peace of Mind?

EWA offers many benefits for businesses managing their workforce:

- Simplified Hiring: Businesses can quickly find and hire the right workers without spending too much time or money. This is important during peak seasons when time is limited.

- Improved Worker Satisfaction: When workers get paid quickly, they feel valued and secure. This makes them more likely to stay with the company for the entire season.

Happy workers are more productive and provide better service to customers.

- Reduced Administrative Burden: Handling payroll for many temporary workers can be complicated. EWA takes care of this, freeing up time for businesses to focus on other important tasks.

- Enhanced Financial Stability for Workers: By allowing early access to pay, workers can manage their finances better and avoid costly payday loans. This support helps workers stay focused and perform well in their jobs.

Why Choose EWA for Your Financial Peace of Mind?

EWA offers fast access to your already-earned money. You do not have to wait for payday when urgent bills pop up. This option reduces the stress of unexpected expenses. You can stay clear of high-interest loans or hefty overdraft fees. EWA fits into your daily life by letting you cover costs without relying on debt. Employers also benefit because workers feel more secure. That sense of relief can lead to higher morale and better attendance. With EWA, you have more control over your finances. This improves budgeting and lets you focus on your work and personal goals.

EWA’s Impact on Business Efficiency

EWA enhances workplace productivity. When employees worry less about monetary aspects, they strive harder leading to more efficient employment. The necessity to spend money on unexpected developments reduces absenteeism while employees’ wages can be accessed at the click of a button, making employees feel cared for, hence boosting their morale. Such positive feelings result in greater cooperation and increased loyalty. Working with companies that pay attention to how their employees are doing financially translates into a reduction in employees’ turnover rates, as these companies are appreciated by their workforce. There are increased efficiency and better performance because of a smoother schedule and functioning of this system. EWA is a glaring example of a functional tool that businesses can use to work and achieve enhanced productivity and employee happiness.