HR departments spend significant amounts of resources recruiting and retaining human resources. In recent times, the scope of employee benefits has also extended beyond residence and retirement plans. Among these new important trends is Earned Wage Access (EWA). EWA works in a way that allows employees to have access to their earnings before their official payday. In this post, we’re going to understand how EWA helps with employee retention, divisional age employee impacts, costs of the employers and its successful implementation.

What is EWA in HR?

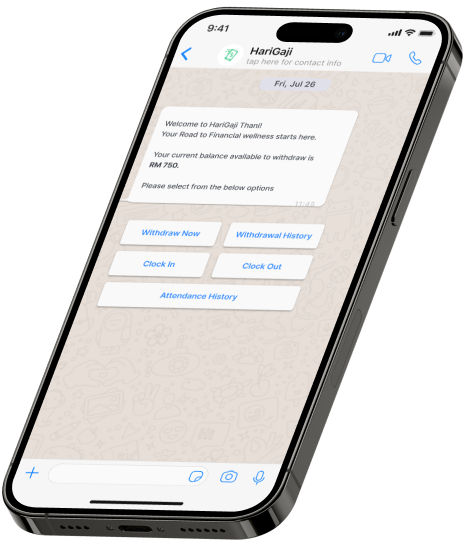

For HR, Earned Wage Access is more than just a financial tool. It is a way to tackle common problems like financial stress, high employee turnover, and low engagement. By giving employees the flexibility to access their wages when they need them, HR can increase job satisfaction and loyalty among workers.

Why Retention Matters More Than Ever

HR departments spend significant amounts of resources recruiting and retaining human resources. In recent times, the scope of employee benefits has also extended beyond residence and retirement plans. Among these new important trends is Earned Wage Access (EWA). EWA works in a way that allows employees to have access to their earnings before their official payday. In this post, we’re going to understand how EWA helps with employee retention, divisional age employee impacts, costs of the employers and its successful implementation.

EWA Targets Different Demographics

Millennials: Numerous millennials are entangled in student debt and are in dire need of financial aid. EWA serves such customers by offering flexible payments and enabling them to avoid excessive reliance on credit.

Gen Z: The younger generation anticipates being paid on delivery for their services. EWA caters to that by providing instant access to cash and quick service.

Older Employees: Employees who are about to retire can utilize EWA to meet their unplanned costs without taking out loans at exorbitant interest rates.

Hourly/Shift workers. Hourly employees have greater variability in both their work hours and their income. This variability hinders the effectiveness of their budgeting. EWA aids in smoothing their income.

Concrete Benefits of EWA for Retention

Reduced Financial Stress Leads to Greater Loyalty

Financial stress is a major reason why employees miss work or become disengaged. When employees can access their wages early, they feel more secure and are more likely to stay with their employer.

Enhanced Job Satisfaction

EWA is a useful benefit that directly helps employees solve financial problems. This makes it more valuable than some traditional perks like free coffee or snacks in the office.

Lower Absenteeism and Tardiness

With access to their wages, employees are less likely to miss work due to money problems like transportation or childcare costs. This reliability strengthens their relationship with the company.

Positive Word-of-Mouth

Employees who benefit from EWA often share their positive experiences. This can make your company more attractive to new hires through referrals.

Potential Challenges for HR

Cost to the Employer: Some EWA providers charge employees directly, while others may require employers to pay platform fees. HR needs to evaluate the return on investment by looking at improved retention and reduced turnover.

Overuse Concerns: There is a risk that some employees might misuse EWA if they lack good budgeting skills. HR can address this by offering financial counseling alongside EWA.

Integration with Payroll: Implementing EWA can be technically challenging if your payroll system is not set up for real-time wage tracking. It’s important to ensure smooth integration to avoid disruptions.

Implementation Best Practices for HR

Partner with Reputable Providers

Choose EWA providers with a good track record and clear fee structures. Ensure they understand your payroll processes to make integration easier.

Pilot Programs

Start with a small group or department to test the EWA program. Gather feedback and use the data to improve and expand the program effectively.

Employee Education

Provide training sessions or online resources to teach employees how to use EWA responsibly. This helps prevent overuse and encourages healthy financial habits.

Secure Data and Compliance

Work with your IT and finance teams to ensure that EWA integration is secure and complies with labor laws. Protecting employee data is crucial to avoid legal issues.

Measuring Success

To show that EWA is working as a retention strategy, HR should track key metrics:

- Turnover Rate: Compare the turnover rate before and after implementing EWA.

- Absenteeism: Check if there are fewer unplanned absences or tardiness.

- Utilization Rates: See how often employees use EWA to ensure it meets their needs.

- Employee Satisfaction Surveys: Ask employees if EWA improves their morale and job satisfaction.

Future Trends in EWA for HR

As on-demand pay becomes more popular, we can expect:

- Wider Adoption: More businesses, from small companies to large corporations, will include EWA in their benefits packages.

- AI Integration: Predictive tools may help employees manage their withdrawals better and develop healthier financial habits.

- Global Expansion: EWA will spread to other countries where payday cycles cause similar financial stress for workers.

Conclusion

Earned Wage Access is a powerful tool for keeping employees, especially when used as part of edge in attracting and keeping talent. For HR teams, the key to success is careful planning, As a broader HR strategy. It addresses a key need for financial security among modern workers. By reducing turnover costs, boosting morale, and increasing loyalty, EWA gives companies an

competition for top talent grows, EWA stands out as a valuable benefit that offers clear communication, and ongoing support. When employees learn to use EWA wisely and see it as part of their overall financial wellness, the result is a more stable and satisfied workforce. immediate and lasting benefits for both employees and employers.