EWA (Earned Wage Access) integration with payroll systems is transforming how employers manage employee benefits. By seamlessly incorporating EWA into payroll, businesses can offer greater financial flexibility, improving employee satisfaction and retention. This step-by-step guide will explain how EWA integrates with payroll systems and how it can streamline your payroll process.

Understanding Payroll Management Systems (PMS)

Payroll Management Systems (PMS) promote the easy processing of salary wages, tax deductions, and other benefits by automatically executing such processes. The software diminishes the risks of human error, allows compliance, and frees considerable time for an HR department to manage its payments efficiently. By integrating with Earned Wage Access Integration with Payroll Systems, PMS can empower employers to provide earned wage access in real-time without disrupting traditional payroll cycles.

2. Why Integrate EWA with Payroll Systems?

EWA and Payroll Compliance and Security integration benefits both employers and employees by simplifying payroll management and offering financial support. Here’s why integration is valuable:

- Increased Employee Satisfaction: Access to earned wages improves financial stability, reducing employee stress and boosting morale.

- Enhanced Retention Rates: Offering flexible financial benefits helps retain talent, especially in industries with high turnover.

- Simplified Payroll Management: Integration automates payroll deductions and adjustments, reducing administrative tasks and errors.

- Improved Financial Health and Productivity: Employees offered Benefits of EWA for Employers and Employees are less likely to take payday advances and thus be financially healthier and more productive.

EWA improvement in payroll increases the efficiency of a payroll system and gives employees control over their earnings, leading to a more satisfied workforce with better financial security.

3. Step-by-Step EWA-PMS Implementation

How to Integrate EWA with Payroll Management System requires coordination between payroll and the EWA provider so that the experience is smooth for the employee. To that end, here’s a stepby-step process to help an employer do that:

- Step 1: Synchronize Payroll Data The EWA solution connects with the Payroll Management System with Earned Wage Access to synchronize important data, including hours worked by employees, wages, and deductions. This synchronization at the onset permits real-time access to payroll data with accurate wage accruals.

- Step 2: Calculation of Available Earned Wages The EWA system calculates the portion of earned wages accessible to each employee, provided employer policies allow it. This ensures employees can access wages without disrupting payroll.

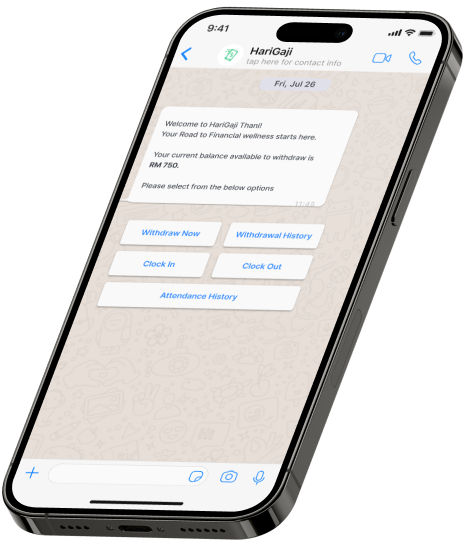

- Step 3: Employee Access to Earnings Employees can access earnings by requesting a portion of wages through the EWA app or portal, with funds disbursed directly to bank accounts or other payment methods. This provides quick and convenient access to needed funds.

- Step 4: Automated Reconciliation with Payroll Accessed wages will automatically be deducted from employees’ paychecks at the end of the payroll cycle, streamlining payroll processing and ensuring accuracy, keeping both EWA and Payroll Compliance and Security in place.

4. Choosing the Right EWA Provider

Selecting a reliable EWA provider is essential to make the integration with PMS smooth and beneficial for employees. Consider the following factors:

- Compatibility with Payroll System: Ensure the EWA provider is compatible with your Payroll Management System with Earned Wage Access, which will avoid costly adjustments.

- Data Security and Privacy: Choose a provider with encryption and data protection protocols to secure payroll and financial information.

- Customizable Options: A flexible EWA provider allows employers to set withdrawal limits, frequency caps, and other policies aligned with company standards.

- Employee Support Services: Reliable support helps employees understand and use EWA effectively, reducing queries for HR.

By selecting a provider aligned with organizational needs, Earned Wage Access Integration with Payroll Systems can maximize employee satisfaction.

5. Ensuring Compliance and Security in EWA-PMS Integration

Data privacy and regulatory compliance are paramount in payroll processes. To ensure security in EWA and Payroll Compliance and Security, consider these aspects:

- Secure Data Transfers: Confirm that all data transfers between the EWA platform and PMS are encrypted.

- Regulatory Compliance: Both EWA and payroll systems must comply with data protection laws such as GDPR and CCPA.

- Audit Trail and Transparency: Track transactions to ensure transparency in wage access and payroll adjustments.

Employers who prioritize EWA and Payroll Compliance and Security build trust with employees and meet all regulatory requirements without compromising data safety.

6. Overcoming Common Challenges in EWA-PMS Integration

While Earned Wage Access Integration with Payroll Systems offers clear benefits, employers may face some challenges, such as:

- Technical Compatibility: Ensure PMS can support EWA integration.

- Employee Training: Training on how EWA works helps employees access wages responsibly.

- System Updates: Regular updates ensure compatibility, security, and functionality.

Employers can overcome these challenges by working closely with EWA providers and conducting regular reviews to optimize performance.

7. Conclusion: The Benefits of EWA-PMS Integration for Employers and Employees

Integrating Earned Wage Access with Payroll Management Systems is a valuable step for employers to support workforce financial wellness. By selecting the right provider, ensuring compliance, and following integration steps, employers create a positive work environment.

Benefits of EWA for Employers and Employees include reduced administrative tasks, improved satisfaction, and retention— positioning the company as a supportive workplace.