Introduction

EWA (Earned Wage Access) is revolutionizing employee benefits by offering improved financial wellness, enhanced workplace satisfaction, and increased productivity. With EWA, employees can access their earned wages anytime, making financial management easier and boosting morale in the workplace.

The Rise of Financial Wellness in the Workplace

Financial wellness has become a critical aspect of employee well-being. According to studies, financial stress affects nearly 60% of workers, leading to decreased productivity, higher absenteeism, and a decline in overall job satisfaction. Employers are increasingly recognizing that financial stability plays a crucial role in maintaining a happy, engaged workforce.

EWA directly addresses this issue by bridging the gap between earning and accessing wages. Employees no longer have to rely on high-interest payday loans or credit cards to cover unexpected expenses. Instead, they can access their hard-earned money when they need it, fostering a sense of financial independence and security.

For employers, investing in financial wellness initiatives like EWA pays off. Not only does it reduce turnover, but it also creates a positive workplace culture where employees feel valued and supported.

Key Benefits of EWA for Employees

Enhanced Recruitment and Retention

In competitive job markets, offering EWA can set employers apart. This benefit appeals to prospective employees, particularly in industries with high turnover rates.

Boosted Productivity

Financially stressed employees are less focused and more likely to miss work. By addressing these concerns, EWA helps employers maintain a motivated and engaged workforce.

Improved Employee Morale

EWA demonstrates that employers care about their employees’ well-being. This fosters a positive work environment and boosts morale across the organization. Cost Savings

By reducing turnover and absenteeism, EWA indirectly lowers recruitment and training costs. It’s a win-win solution for both employers and employees.

EWA and Modern Workplace Trends

The Gig Economy

The rise of the gig economy has made traditional payroll systems outdated. Freelancers, contractors, and gig workers often prefer flexible payment options, making EWA an ideal fit for this workforce.

On-Demand Culture

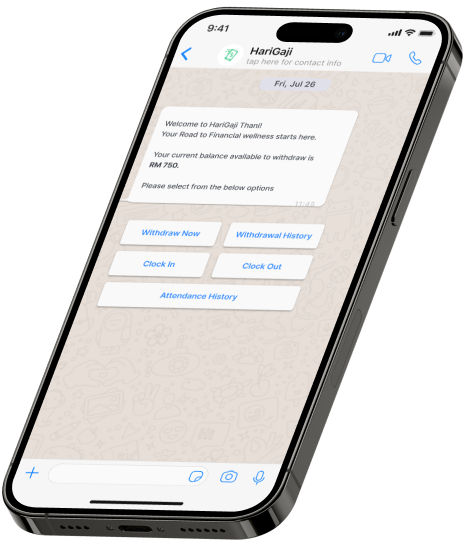

Today’s employees expect instant solutions, from food delivery to ride-hailing services. EWA aligns with this on-demand culture by providing instant access to earned wages.

Personalized Payroll Solutions

EWA represents a shift towards customizable payroll services that cater to individual employee needs, reflecting broader trends in workplace personalization.

Challenges and Concerns of EWA Implementation

Regulatory Hurdles

EWA providers and employers must navigate a complex web of labor laws and regulations to ensure compliance. Cost of Integration

Implementing EWA platforms requires upfront investment in technology and training. Employers need to evaluate the long-term ROI before adoption.

Employee Education

While EWA is a powerful tool, employees must be educated on its responsible use to prevent misuse or overreliance.

The Role of EWA in Enhancing Employee Experience

EWA isn’t just a financial tool—it’s a cornerstone of a broader employee experience strategy. By addressing one of the most common sources of stress, EWA enables employees to focus on their work and personal growth.

Positive feedback from employees who have used EWA highlights its transformative impact on their financial well-being and job satisfaction. When combined with other HR initiatives, such as flexible schedules and wellness programs, EWA becomes a powerful driver of employee loyalty and engagement.

Financial Inclusion and EWA

EWA plays a pivotal role in promoting financial inclusion, especially for unbanked and underbanked workers. By offering access to wages without the need for traditional banking infrastructure, EWA helps bridge the gap for marginalized groups.

Additionally, many EWA platforms incorporate financial literacy tools, empowering employees to make informed decisions about budgeting and saving. This combination of access and education fosters long-term financial stability.

Future of Earned Wage Access

As EWA continues to gain traction, several trends are shaping its future:

Increased Adoption Rates

More companies across industries are expected to adopt EWA as it becomes a standard workplace benefit.

Technological Innovations

AI and data analytics will further enhance EWA platforms, offering personalized insights and recommendations for users. Global Expansion

EWA is likely to expand beyond the US, addressing the financial needs of workers worldwide.

Conclusion

Earned Wage Access (EWA) is more than just a financial benefit—it’s a revolutionary approach to modern workplace benefits. By addressing financial stress and enhancing employee satisfaction, EWA sets a new benchmark for what it means to support a workforce. For employers looking to stay competitive and foster a loyal, productive team, EWA is no longer optional—it’s essential.