Financial literacy and wellness programs now form an integral part of employee well-being. Their goals include employees’ reducing worry regarding their money and even assisting with making factory floors safer. Employees working in a factory are required to be attentive and meticulous, which at times can be interrupted by challenges such as blood pressure and/or money issues. To be able to sort these challenges out, employers introduce several wellness programs, such as wage advances and early wage access. By doing so, these programs make factories safer. This blog will describe how financial well-being programs ensure factory safety by lowering employee errors, assisting them to concentrate, and enhancing group performance.

About the workplace, it is clear that money-related issues are a concern in the manufacturing environment, and there is a direct relationship between an employee’s financial condition and workplace safety.

The Connection Between Financial Stress and Workplace Safety

Money problems can impact how employees think and act at work. When workers are under financial stress, they might experience worry, lack of sleep, or reduced focus. These issues can make it harder for them to perform their tasks safely. In factories, even small mistakes can lead to serious consequences. Financial stress often causes workers to:

- Make errors while handling machines.

- Overlook or forget important safety measures.

- Feel exhausted due to poor sleep patterns.

- Struggle to communicate or collaborate effectively with colleagues.

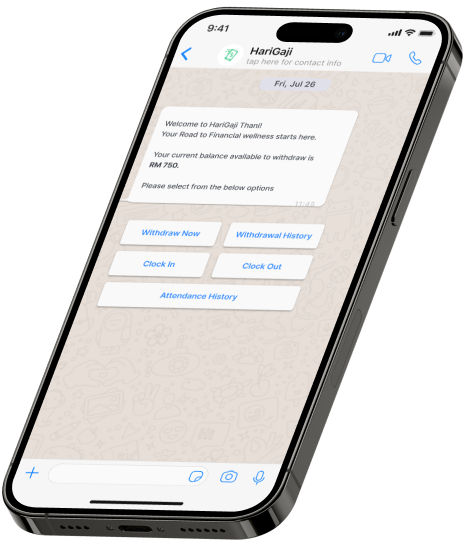

Helping employees manage financial stress can reduce these risks significantly, ensuring a safer and more productive workplace. Employers who invest in their workers’ financial well-being with solutions such as instant wage access and on demand pay create a culture of safety and responsibility. Better Focus and Attention on Tasks

Programs that support financial wellness assist workers in feeling as though they have a grasp on their monetary situations. Such programs usually have budgeting tools, debt relief strategies, and education about finances. A worker who is at peace about their finances is in a better position to concentrate on their work. This improvement in focus minimizes the risk of accidents and mistakes.

A worker using heavy tools may, for example, start thinking of unpaid bills or an increasing amount of debt and, as a result, become an accident waiting to happen; this is how easily this distraction can happen. With such thoughts dealt with through wellness programs like early wage access and salary advances, employers enable workers to maintain focus and awareness in the workplace, making it a safer space.

Less Absenteeism and Presenteeism

Economic stress experienced by workers manifests itself in two stark yet debilitating forms: the process whereby someone fails to report for work is termed absenteeism, whilst the act of being physically present at work while remaining emotionally and mentally disengaged is termed presenteeism. Both of these situations can greatly exacerbate the safety of a workplace.

In situations of absenteeism, fewer employees mean that more work must be done by the staff that is present, which increases the chances of mistakes being made. Further, presenteeism also has potential hazards since those who are not focused on their work due to any reason may not only compromise safety but may also not abide by required processes.

However, through the adoption of financial wellness programs such as wage advances,instant wage access, oron demand pay, employers attempt to combat both absenteeism and presenteeism. Employees become more engaged and concentrated during their shifts instead, and these shifts are less likely to become missed altogether. As a result, employees are in optimum working conditions since they are free of fluid or static economic duress and are in turn able to be more productive and efficient.

Higher Morale and Teamwork

A positive work environment relies heavily on good morale and teamwork. Financial stress can create tension among workers, leading to conflicts and reduced cooperation. Low morale can also result in complacency, where workers become less vigilant about safety measures.

Financial wellness programs, such as instant wage access or salary advance, show employees that their employer cares about their overall well-being. This boosts morale and fosters a sense of community within the workplace. Workers who feel supported are more likely to collaborate effectively, follow safety protocols, and look out for one another. Improved teamwork, aided by programs like wage advances, translates to a safer and more harmonious factory floor.

Smarter Decisions Under Pressure

Factory workers often face situations that require quick decision-making. Financial stress can cloud judgment and slow down response times, increasing the risk of accidents. A distracted worker may struggle to make the right call during an emergency or fail to address a potential hazard in time.

Financial wellness programs like early wage access and instant wage access help workers feel more confident and focused. With reduced stress, they can think more clearly and make better decisions under pressure. This clarity ensures that workers can respond effectively to challenges, maintaining safety and efficiency on the factory floor.

ROI of Financial Wellness Programs

Financial wellness programs not only improve safety but also deliver measurable returns on investment (ROI) for employers. Fewer workplace accidents result in lower costs associated with medical expenses, legal fees, and lost productivity. Additionally, reduced absenteeism and turnover lead to savings in recruitment and training costs. By enhancing employee engagement and satisfaction through tools like salary advance and on demand pay, these programs contribute to a more productive and cost-effective operation.Long-Term Benefits of Financial Wellness Programs

Practical Steps to Implement Financial Wellness Programs

In this section, we give our readers some practical steps to implement a successful financial wellness program. First, we focus on the issues related to non-profits and community efforts. Empowering employees with adequate financial education ensures that everyone is working towards the same goal—financial wellness.

Define Financial Education: Lead Employees Toward Achieving Financial Independence

Define Your Employee Groups: Develop Strategies According to Gender, Income, Age

Develop the Program According to Needs: Mandatory education in any organization should be extensive, logically structured, and flexible depending on previous knowledge. The program should address financial independence opportunities.

Consider Employee Benefits: Managing Credit and Financial Obligations over Time

Target Employees: Understanding Employee Needs and Company Goals for Advancement Set realistic goals and timeframes. If your aims are unrealistic, this becomes discouraging at all levels of management too.

The Bigger Picture: Financial Wellness and Workplace Safety

Workplace safety and efficiency can be improved through the implementation of programs that target the source of stress, such as wage advances and instant wage access. Financial stress is alleviated, which allows employees to remain engaged and focused. Such programs are more than just a benefit to employees; by investing in such programs, the firm is enhancing productivity, boosting morale, and reducing the risk of accidents. Long-term success is ensured when a financial program is prioritized, and it shows that an employer is committed to the business.