Payroll systems are changing fast. Businesses must keep up with new needs. In 2025, automation will help improve payroll processes. It will save time and reduce mistakes. Employers will use early wage access to give workers financial flexibility. This will help attract and keep employees. Mobile and cloud-based payroll systems will become common. These systems will make access easier and keep data safe. Personalized payroll options will meet employee needs. Compliance and security will remain important to avoid problems. Advanced analytics and HR integration will make systems more efficient. Global payroll solutions and blockchain will simplify payments for remote and international teams. These trends will shape payroll in 2025.

Automation in Payroll

Payroll management automation is altering how repetitive salary computations, taxation deductions, and overtime records are implemented. It accelerates the processes while also reducing errors, making payroll management more accurate and efficient. Payroll teams save time since automated systems generate reports quickly. This technology enables those in the payroll department to deal with other strategic duties, for example, aiding employees, settling payroll-related issues, and budgeting for human resources. Automation

cuts down on manual labor, resulting in improved productivity and precision in payroll activities at large. Moreover, it guarantees conformity to tax laws, thus being important to firms that want to simplify their operations as well as ensure worker contentment.

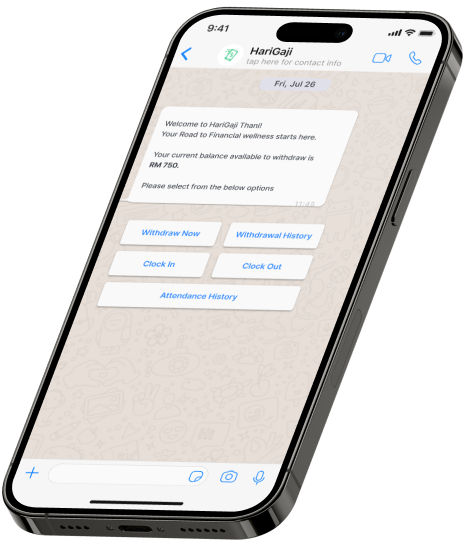

On-Demand Pay

Wage advances are becoming more common. They let employees access part of their earned wages before payday. This gives workers more control over their finances. It helps them handle sudden costs like medical bills or car repairs. Many employees like this option because it lowers financial stress. It also reduces the need for loans or credit cards. Employers can use early wage access to attract new workers. It also helps them keep their current staff. This shows that companies care about their employees’ financial needs.

Wage advances are useful in competitive job markets. Flexible pay options help businesses stand out. This trend is becoming a key part of payroll systems.

Focus on Financial Wellness

Many workers go through financial distress. Currently, there are payroll systems that have instruments to assist employees in managing their finances. To help employees budget and save for emergencies, there are tools like this one provided by several payroll systems. Others even have provisions for talks with financial consultants. This kind of assistance reduces tension and enhances financial comfort. When people are confident about their monetary situations, they will develop better concentration abilities, which they take to work. Also, it enhances productivity and job satisfaction among the employees in focus. Besides, the employers benefit from having economically stable personnel who will be retained within the firms as well while doing good jobs.

Personalized Payroll Options

Employees want payroll systems that meet their needs. Some workers prefer flexible pay schedules. Others may want deductions for savings or retirement plans. Payroll systems are becoming more customizable to meet these needs.

Integration with HR Systems

The reason payroll systems now work with HR tools on one platform is that it makes the processing of employee data easier. Employers can automate activities like recruitment and benefits administration. Consequently, there will be no manual work anymore while at the same time reducing errors in these processes. Therefore, organizations can easily come up with reports as well as assess performance without having to go through extra motions. In addition, employees are not left out of this. They too can have a look at their payment slips and other HR details all under one roof. As such, it saves time for the HR department and simplifies things for both parties involved. Finally, these systems can handle more users as they expand since they are scalable and hence suitable for growing firms. Integrating both payroll and HR duties leads to faster and smoother operations across the board.

Advanced Analytics

Payroll systems recently have added new tools for analytics that help in tracking costs and workforce trends. This assists employers in planning, justifying payroll expenses, and making informed decisions. It also makes it possible to enhance operational efficiency through data- driven decision-making, thereby helping organizations allocate resources more efficiently.

Global Payroll Systems

Multinational payroll systems are responsible for handling taxes, benefits, and currencies across borders. They simplify global payroll and ensure compliance with local regulations. They offer a way of managing global work forces successfully and accurately by businesses.

Employee Self-Service Portals

Employees require easy access to payroll-related information. Self-service portals allow employees to verify their payment history, download tax documents, and update personal data. Manual requests are streamlined, saving time for HR. Workers have the authority over their details so that they can be accessed at any moment through these portals whenever it is only convenient for them. This reduces the administrative tasks an employer has to deal with. As self- service payroll systems continue to evolve, a lot of businesses are adopting this trend. Through these tools, employees feel supported and get important information quickly.

Assistance for Offsite Teams

The remote workforce is growing fast. For example, payroll solutions must adjust to track hours worked by remote employees as well as handle taxes for individuals in various geographies/time zones. Simultaneous payments ensure accuracy between hybrid and virtual team members who benefit from such systems in terms of promptness concerning salary issues but also facilitate employers’ abilities to communicate about pay easily amongst themselves, not forgetting that any worker gets paid on time with no question being raised regarding his/her earnings due date and respective location. Updating payroll systems enables firms to manage remote teams effectively while still providing the flexibility necessary within today’s labor markets.

Training for the Payroll Teams

Employers are offering workers more payment alternatives. Workers may earn bonuses after achieving set targets or receive payments for specific projects. Flexible pay makes it easier to relate compensation with performance. It also enables firms to manage their payroll costs. An employee’s morale is maintained when one is paid according to his/her input. Employers use such structures to attract a highly skilled workforce. By offering flexible pay, businesses show they care about their employees. Thus, it also allows workers to get satisfied and justly rewarded for a job well done. This can be seen when evaluating factors like satisfaction level observed by employees during different stages of employment of an organization.