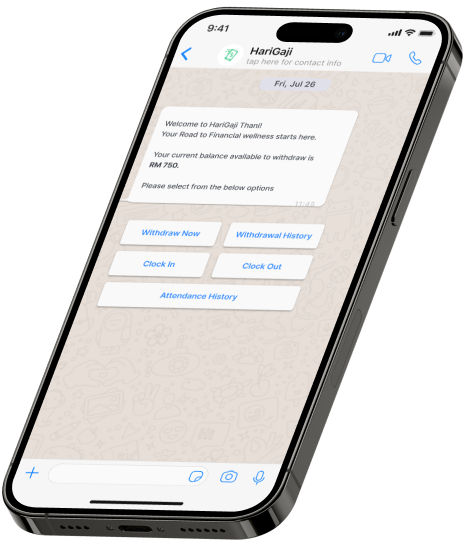

The retail industry is no stranger to change. From shifting consumer preferences to technological advancements, retailers are constantly adapting to stay competitive. However, one of the most transformative innovations in recent years isn’t about how products are sold it’s about how employees are paid. Earned Wage Access (EWA), a financial solution gaining traction worldwide, is revolutionizing the retail sector by giving employees greater control over their wages. Platforms like HariGaji are at the forefront of this shift, offering flexible payment options that benefit both workers and businesses alike.

What is Earned Wage Access?

Earned Wage Access (EWA) allows employees to access a portion of their earned wages before the traditional payday. Instead of waiting two weeks or a month for their paycheck, workers can withdraw funds as they earn them, providing financial flexibility and reducing reliance on highinterest loans or credit cards. This simple yet powerful concept is particularly impactful in industries like retail, where many employees face financial instability due to irregular schedules and lower wages.

The Traditional Pay Cycle: A System Ready for Disruption

The bi-weekly or monthly pay cycle has been the norm for decades, but it doesn’t align with the financial realities of today’s retail workers. Many employees live paycheck to paycheck, and unexpected expenses like medical bills, car repairs, or even daily necessities can cause significant stress between pay periods.

Challenges of the Traditional Pay Cycle in Retail:

- Delayed Access to Earnings: Employees work hard but must wait weeks to receive their wages, creating cash flow issues.

- Increased Debt Dependence: To bridge the gap between paydays, many workers turn to credit cards or payday loans, leading to debt cycles.

- Financial Stress: Constant money worries can lead to anxiety, decreased productivity, and absenteeism at work. It’s clear that the traditional pay system doesn’t meet the needs of today’s workforce, and that’s where Earned Wage Access comes in.

How Earned Wage Access is Transforming Retail

Earned Wage Access isn’t just a perk it’s a game-changer for the retail industry. By offering employees more control over their earnings, retailers can foster a more engaged, productive, and loyal workforce

1. Boosting Employee Financial Health

Financial stress is one of the leading causes of decreased productivity and employee turnover in retail. EWA solutions like HariGaji help alleviate this stress by giving employees access to their wages when they need them, not just on payday.

Benefits for Employees:

- Immediate Access to Funds: Employees can cover urgent expenses without resorting to high-interest loans.

- Improved Budgeting: Flexible access to wages allows for better financial planning and spending control.

- Reduced Financial Anxiety: Knowing they can access earned wages provides peace of mind, improving overall well-being.

2. Enhancing Employee Retention and Engagement

High turnover is a persistent issue in retail. Employees often leave for slightly higher wages or better benefits. By offering EWA, retailers can differentiate themselves as employers who care about their workforce’s financial well-being.

Impact on Retention:

- Higher Job Satisfaction: Employees appreciate the flexibility and financial security that comes with EWA.

- Reduced Turnover Rates: Financially secure employees are more likely to stay with the company long- term.

- Attracting Top Talent: Offering innovative benefits like EWA makes a company more attractive to potential hires.

3. Improving Workplace Productivity

Financial stress can significantly impact job performance. Distracted, anxious employees are less likely to engage effectively with customers and complete tasks efficiently. With EWA, employees can focus on their work without the constant worry of financial shortfalls.

Productivity Gains:

- Increased Focus: Financially stable employees can concentrate better on their tasks.

- Better Customer Service – Happy employees lead to happy customers, driving sales and positive brand experiences.

- Reduced Absenteeism :When employees aren’t juggling multiple jobs or dealing with financial crises, they’re more consistent and reliable at work

Real-Life Impact: Success Stories from the Retail Sector

Retailers worldwide are witnessing the transformative power of Earned Wage Access. For example, a leading retail chain in Southeast Asia partnered with HariGaji to implement EWA for their workforce. The results were remarkable:

- 20% increase in employee productivity, as financial stress was significantly reduced.

- 15% decrease in turnover rates, with employees reporting higher job satisfaction.

- Improved customer service ratings, as employees were more engaged and motivated.

Employees shared stories of being able to manage unexpected expenses without resorting to debt, leading to better mental health and a stronger connection to their workplace.

Why Retailers Should Embrace Earned Wage Access

The benefits of EWA extend beyond just employee satisfaction. For retailers, adopting this innovative payment model can lead to substantial business gains.

- Operational Efficiency: By reducing turnover and absenteeism, retailers save on recruitment and training costs. A stable workforce means smoother operations and better team cohesion.

- Enhanced Brand Reputation: Companies that prioritize employee well-being are viewed more favorably by both customers and potential hires. Promoting EWA as part of your employee benefits package can enhance your brand’s image

- Competitive Advantage: In a crowded retail landscape, offering unique benefits like Earned Wage Access can set your business apart. It shows that you’re forward-thinking and committed to supporting your employees.

Conclusion: The Future of Pay in Retail

Earned Wage Access is more than just a financial tool—it’s a revolution in how retail businesses support their employees. By providing workers with immediate access to their earnings, platforms like HariGaji are helping retailers foster a healthier, happier, and more productive workforce. In an industry where customer service and operational efficiency are paramount, investing in your employees’ financial wellness isn’t just good ethics—it’s good business. As the retail landscape