Implementing EWA to simplify payroll administrative burdens is becoming essential for businesses aiming to enhance efficiency. As companies expand, the complexity of payroll systems can create significant administrative challenges. Traditional payroll processes are often slow and prone to errors, demanding extra effort from HR teams. By adopting EWA to simplify payroll administrative burdens, businesses can streamline the process and offer employees faster access to their earned wages. This reduces the need for complex payroll calculations and makes adjustments easier. With EWA, companies can save time, improve payroll accuracy, and boost employee satisfaction. In this guide, we’ll dive into how EWA to simplify payroll administrative burdens can be implemented to improve payroll efficiency and reduce operational cos

What is Employee Wage Access (EWA)?

Employee Wage Access (EWA) is a wage disbursal assistance program that provides its users with an opportunity to avail of a part of their salary before the traditional payday. Pay day loans are quite different from wage access programs as the latter offer real-time solutions to the employees which in turn enables the employees to use only their earned funds which are not all encumbered with usury. As an example, the automation linking EWA with payroll systems is one way how employers can give employees these benefits while also automating the administration.

There are two primary types of EWA solutions:

On-demand wage access: Whenever a user requires to withdraw a certain percentage of their salary can do so by relieving some of their earnings.

Scheduled wage access: Taking many small sums during the payment period as wage replacement instead of making the entire payment at once.

Challenges in Payroll Administration

Complications related to payroll management cut across all sectors making even the most competent teams’ efficiency to be reduced. Some of these issues are:

Time-Consuming Processes:It is common how payroll teams dedicate many hours calculating earnings or adjusting tax withholdings to ensure payments are made on time.

Increased Risk of Errors: Deployed systems which are too old or having manual processes can lead to employees’ calculation errors which in turn leads to complications with respect to employee relations.

Compliance Complexities: It is necessary for businesses to comply with changing tax laws, labor laws and also reporting techniques which increases the intricacy of wage administration.

Most basic payroll systems do not offer the needed agility to curb these issues efficiently, so that is where the need for the integration of new technological application like EWA comes in handy.

Benefits of EWA in Payroll Administration

Reduced Time Spent on Payroll Processing

EWA systems are designed in ways that eliminate quite a number of tasks such as time tracking, wage computation, disbursement, among others and hence the cancerous time spent disbursing wages can be spent on more relevant activities. This enables them Payroll teams to be more focused on strategic activities rather than mundane administrative activities.

Lower Risk of Payroll Errors

EWA through automation of various basic and routine processes minimizes the calculations potential errors thereby guaranteeing employees pay and/or wage on time and in most cases due time. This reduces the scope of the disputes and enhances the confidence of the employees and the employers.

Enhanced Employee Satisfaction and Retention

There is no argument that providing EWA as an employee benefit means the company cares about its employees and their wellbeing. Those employees who are the first to get access to their earnings may not find themselves in such a great deal of financial strain and stress, and in return, this would increase the job satisfaction and thus retention rates.

How EWA Streamlines Payroll Processes

Automated Calculations and Data Integration

EWA platforms will easily connect and work with existing payroll systems. This integration enhances automation by eliminating key manual tasks like tracking the working hours of employees, tax calculation and making payments. Such integration also improves EWA by minimizing calculation errors while expediting the processes of payroll.

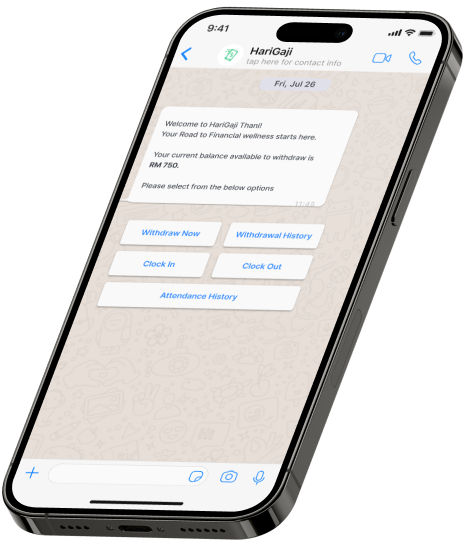

Real-Time Access to Wages for Employees

What most people find interesting about EWA is that workers can access their earned wages at any specific point in time. An employee can log into their accounts, check how much they have already earned, and then withdraw as much money as required. With such real-time capability, payroll teams will no longer be required to process advance requests manually, this will help reduce the administrative time immensely.

Simplified Compliance and Reporting

EWA solutions will encompass compliance tools that meet the required labor and taxation law. Compliance tools create reports which contain detailed information, thus making audits and exclusive submissions easier and less time consuming.

Key Features of EWA Platforms That Aid Payroll Teams

Modern EWA platforms are equipped with features tailored to ease payroll management. Key functionalities include:

- User-Friendly Dashboards: Intuitive interfaces enable payroll teams to monitor and manage wage access requests efficiently.

- Integration with Payroll Software: Compatibility with existing payroll systems ensures a seamless transition and reduces the need for additional training.

- Real-Time Updates: Platforms provide real-time data on employee earnings and withdrawals, allowing for accurate financial planning.

- Automated Scheduling: EWA systems can be set up to process payments automatically, eliminating the need for manual intervention.

Conclusion

EWA is transforming the world of Payroll Management by overcoming back-end challenges of the traditional systems. EWA stands for Employee Wage Access and it takes off the pressure of formalities and unnecessary errors, so it much enhances the experience of employees and thus is helpful for businesses that want a more efficient way of dealing with payrolls.

For businesses that want to remain competitive you can no longer afford to not adopt EWA. Get started toward easier and more efficient payrolls by looking at various EWA options made to fit your company.