The payroll landscape is changing, and on demand pay, otherwise called earned wage access (EWA), is the trend. This inventive answer enables workers to earn wages before the conventional payday, giving them flexibility and financial liberties. The industry has embraced on-demand pay, and employers and employees are praising it for various reasons: better financial security, less stress about cash, and higher job satisfaction. In today’s financial situations, workers’ happiness and loyalty are increasingly influenced by the presence of on-demand pay .Embrace the future of payroll through EWA and redefine financial accessibility today.

What Is On Demand Pay?

Instead of waiting for the next payday, on-demand pay empowers workers to access parts of their salaries when they need it. For instance, if someone has worked a week and needs to repair their vehicle, they can immediately get some money from what they have earned. This is helpful in that it caters to unplanned expenses.

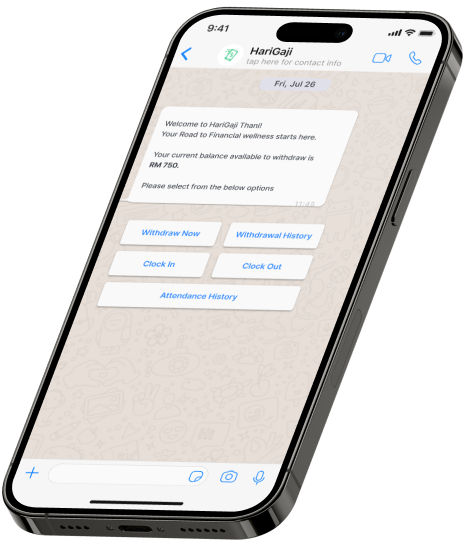

Here is how it works:

Real-time employee hours tracking by employers

Requesting earned wages through an app

Transferring the requested amount into either a bank account or prepaid card On the regular payday, the advanced amount is deducted from their paycheck.

Why Is On-Demand Pay Becoming Popular?

Popularly known as on-demand pay, this concept provides workers with the ability to obtain their wages that have been earned in advance of when they are due for payment.

Consequently, this method reduces personal monetary pressures, increases job satisfaction, and enables employers to increase retention levels, hence becoming an ideal response for today’s workplaces.

Benefits for Employees

Financial Flexibility: Workers can cope with unforeseen bills like medical costs or house repairs without resorting to credit cards and payday loans.

Reduced Stress: Income access relieves employees’ financial stress so that they can concentrate on their work.

Better Budgeting: Immediate money transfer enables employees to be more organized in their financial management.

More Control: Employees are empowered when they can determine when they collect salaries.

Benefits for Employers

Increased Job Satisfaction: This way, workers appreciate being able to have some financial flexibility, which keeps up their spirits and loyalty.

Recruitment Advantage: On-demand pay is an appealing feature for candidates applying for jobs, thus making it easier for organizations to acquire the best talent available in the market.

Lower Turnover: This saves companies from replacing departing staff due to money issues, hence avoiding the time and cost of recruitment and training the new workforce.

Ease of Use: Such contemporary systems today are seamlessly integrated with conventional payroll solutions, therefore making the installation process easy.

How Big Companies Use On Demand Pay

Top companies like KFC, McDonald’s, and Taco Bell are relying on payday solutions such as Instant Financial to support their workforce. With this model, employees are informed after completing their shift whether they want to receive the wage that has been earned

immediately or until the payday. This approach easily accommodates workers’ requirements in light of their living from hand to mouth as it minimizes money anxieties and improves work fulfilment levels. Payroll management is being reshaped by on-demand pay, hence becoming a critical factor in improving employee retention and engagement.

Boosting Workplace Productivity

Workplace productivity can be significantly impacted by financial stress. The latter leads to reduced focus and decreased efficiency among workers when they are preoccupied with money issues. To manage this problem, there is a provision of earned wage access (EWA) or on-demand pay. On the one hand, as a solution to this concern, employees at different organizations can benefit from on-demand pay; it allows workers to obtain their earned salaries earlier than expected before payday. In this way, employees will have the necessary financial resources that will help them live better lives.

Also, it motivates individuals and increases their engagement levels at work when they realize that if such unexpected expenses occur, they do not have to worry about finances anymore. A workforce that has financial security regarding its members is more likely to concentrate on its tasks and be productive in what it does, leading to loyalty towards organizational goals. As

employers should adopt on-demand pay for enhanced satisfaction among staff members, increased retention rates and high morale in workplaces would be identified.

Integrating On-Demand Pay With Financial Wellness

More than just paying in advance, on-demand pay also leads to financial health. Different platforms have budgeting assistance, tools for savings, and planning capabilities that help employees manage their money better. With these features, workers can monitor their expenses, fix objectives for saving, and improve on spending habits. Employees will therefore be able to achieve more stability over long periods by cutting down the reliance on high- interest loans or credit cards. Offering such instruments builds trust with employers and supports employee commitment to make a financially healthy workplace culture.

Consequently, this overall approach is beneficial not only to individuals but also improves general productivity and satisfaction, hence winning all involved parties.

Helping Employers Attract Talent

As companies compete in a tight job market, on-demand pay is a differentiator. Workers desired benefits that fit their money matters. On-demand pay signals an employer’s concern for the welfare of its workers, thus attracting skilled employees and easing recruitment.

Improving Retention Rates

A high employee turnover rate is expensive for companies to handle. One of the leading causes of employees quitting is financial stress; thus, on-demand pay helps retain them. When workers feel supported, they are more likely to stay.

Costs for Employers

For some businesses, there are fees charged for their services. For this reason, employers have to decide whether they will bear these costs or pass them over to employees. It is important to communicate clearly about the fees to avoid confusion.

Future of On-Demand Pay

With the improvement of technology, on-demand payrolls will offer additional functionalities. These can consist of tools used in saving and managing money. To stay ahead in hiring and retaining employees, employers should embrace these changes.

Steps for Employers to Start

The following are some steps that businesses could take to implement on-demand payroll:

Research Providers: Choose the best among different systems based on comparison.

Train Staff: Make your HR and payroll teams understand how it operates.

Explain to Workers: Show ways workers can employ it and what they should expect.

Collect Feedback: Get their opinion to enhance it.