Introduction

Financial stress hits manufacturing hard. It causes cash flow issues, pay problems, and budget limits. When companies can’t pay good wages or offer a salary advance, workers face money troubles. This makes them unhappy at work. Many then quit and look for better jobs.

Losing workers costs a lot. Hiring and training new people takes time and money. It also slows production and lowers quality. Offering a salary advance can help alleviate some financial pressures, encouraging employees to stay. Workers who stay get more work, which leads to stress. This makes them tired and less happy. When people leave too much, the company’s name suffers. Then it becomes hard to find skilled workers.

What Is Financial Stress and How Does It Affect Employees?

Financial stress is the worry people have when they think they do not have enough money. They may need to cover rent, pay bills, or save for emergencies. In manufacturing, this stress can show up in many ways:

- Some employees live paycheck to paycheck. A small extra expense, like a car repair, can become a major crisis.

- Many workers have credit card debt or personal loans with high interest.

- Some do not have any savings, so even small problems become big issues.

The Link Between Financial Stress and High Turnover

The issue of financial stress is a huge problem for employees and even employers. Also, it influences many aspects of work, including attitude towards it. A plethora of surveys demonstrates that financial issues tend to make employees voluntarily terminate employment.

On the other hand, when an employee has a financial issue, their ability to concentrate gets compromised. As a result, they tend to make several errors. This, in turn, creates an unhappy environment as well. Even managers may find themselves in a discontent state regarding their work. Afterwards, employees could look for other jobs that offer better salaries.

Money problems also affect workers’ feelings. They feel worried and tired. They might feel sad or stressed all the time. This makes them less interested in their work. If they feel their jobs do not help, they might leave.

When workers quit, companies lose time and money. Hiring and training new workers takes a lot of effort. When people keep leaving, it also makes teams weaker. It hurts how everyone works together.

Payments can be managed in a more efficient way, which could save workers a great deal of stress; hence, some companies have opted to effectuate plans that would enable workers to get a salary advance or even allow them to pay early. As for staying in a company for an extended period, that solely depends on the lesser amount of stress workers get; if they feel content, they would.

The Hidden Costs of Employee Turnover in Manufacturing

Turnover does not just mean replacing one worker with another. It is expensive. Some hidden costs are:

- Hiring and training: Employers pay for job postings, recruitment, and training. New hires take time to learn, which slows production.

- Reduced productivity: When someone quits, the rest of the team must do more work. This can cause delays and lower efficiency.

- Quality problems: Changing staff can lead to errors in production. This hurts a company’s reputation and may cause customers to leave.

- Bad workplace culture: When turnover is high, remaining workers may feel uneasy. They might also consider leaving.

Reducing turnover by fixing root issues, like financial stress, is often cheaper than hiring and training new people all the time.

Why Traditional Solutions May Not Be Enough

Many companies try to help their workers. They do this by giving small raises or yearly bonuses. These help a little. But they do not fix daily money problems. For example, a sudden bill may come before payday. Even with a bonus, workers may still not have enough money.

Some employers offer financial training. Others set up savings plans. These steps are good. But they take a long time to work. During this time, workers may need to borrow money. They may use high-interest loans or credit cards. These can make their money problems worse.

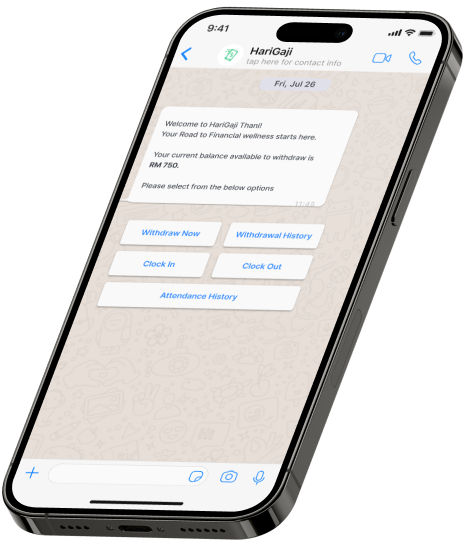

This is where earned wage access helps. EWA lets workers get part of their pay early. It fills the gap between working and getting paid. This makes it easier to handle sudden costs without borrowing.

How Earned Wage Access (EWA) Can Help

The concept of earned wage access (EWA) can be traced back to as early as 2004 when they combined the benefits of installments, cashless services, and earned wage access to weave a personal loan product. And allow them to offer services to employees working on their platform, which encouraged more people to sign up. This encouraged the use of earned wage access,meaning people had more options.

As an example, if an employee has billed work for 40 hours in the current pay period, then rather than waiting for the scheduled payday, the employee can enjoy on demand pay and take a portion of it. Thus helping families manage their tension and come out of stress.

In addition, by promoting good budgeting through instant wage access, EWAallows employees to better manage their finances while also avoiding late fees. Hence it has a better appeal for the employees as well as the employers. Moreover, the use of paid earnings improves incentive retention and repayment. Due to this, a smaller workforce also tends to be more stressed.

Real-World Examples and Success Stories

Mid-Size Manufacturer: A company with 500 employees reduced turnover from 5% to 3% monthly after offering early wage access. Employees felt more financially secure.

• Worker Story: An employee used salary advance to pay for a family member’s medical bill, • Management View: Supervisors reported fewer unplanned absences and better morale on avoiding loans and easing stress, which improved job loyalty. the production line, enhancing productivity and stability.

Simple Steps to Get Started

Research EWA Providers: Compare costs, terms, and payroll system compatibility.

- Check Compatibility: Ensure the on demand pay program works with your payroll process.

- Explain to Employees: Inform workers about instant wage access and any associated fees.

- Try a Pilot: Test early wage access in a specific department to evaluate results.

- Track Data: Monitor turnover and absenteeism to assess salary advance’s impact and make adjustments.

Collect Feedback: Ask employees about their experience with Hari Gaji and suggestions for improvement.