Employee retention is one of the biggest challenges in the retail industry. With high turnover rates and the ongoing pressure to meet staffing needs, it becomes increasingly difficult to maintain a stable, skilled workforce. However, a growing number of retailers are discovering that the key to reducing turnover and improving employee satisfaction lies in addressing the financial well-being of their staff. Financial wellness programs, such as Early wage access, offered by platforms like HariGaji, are becoming integral in creating a more stable and satisfied workforce.

The State of Employee Retention in Retail

Retail is one of the most dynamic sectors, but it is also notorious for its high employee turnover rates. Retail workers often face low wages, inconsistent work schedules, and limited benefits, leading to dissatisfaction and ultimately, turnover. According to a study, turnover rates in retail can be as high as 60% annually, which is a significant drain on resources for companies. This high turnover can lead to costs related to recruitment, training, and the loss of experienced staff, all of which directly affect a retailer’s bottom line. To combat this, retailers need to find ways to engage and retain their employees. One of the most effective ways to achieve this is by addressing the financial challenges that workers often face, thereby fostering loyalty and job satisfaction.

What is Financial Wellness?

Financial wellness refers to the ability of individuals to manage their finances in a way that ensures stability, reduces stress, and helps them achieve their personal and financial goals. For retail workers, financial wellness often means having access to tools and resources, such as early wage access programs, that can help them better manage their earnings, budget effectively, and avoid financial stress. In a typical retail environment, many workers are paid on a bi-weekly or monthly basis, which can create significant challenges in managing their day-to-day finances. Employees often live paycheck to paycheck, which means any unexpected expenses—like a car breakdown or medical bill—can create a financial burden. This is where Early wage access (EWA) comes into play, allowing workers to access their earned wages before the traditional payday, reducing the need for payday loan options or reliance on payday advance apps.

How Earned Wage Access (EWA) Supports Financial Wellness

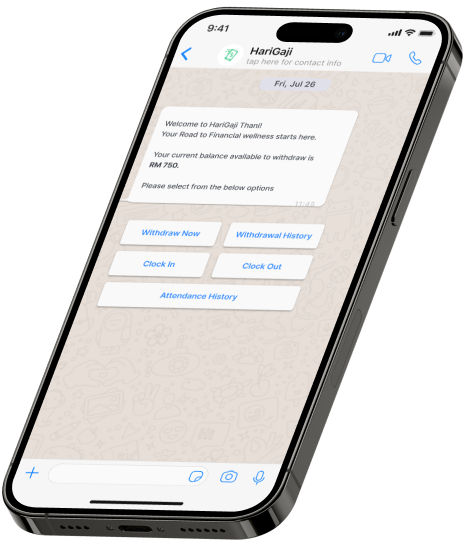

EWA programs, like HariGaji, allow employees to access a portion of their earned wages whenever they need it, without waiting for the scheduled payday. This ability to draw funds when needed gives workers greater financial flexibility, reducing the reliance on payday loans or credit cards.

Here are some key ways EWA supports financial wellness for retail employees:

1. Immediate Access to Funds

EWA provides a safety net for employees, enabling them to access a portion of their earned wages in real-time. This flexibility can help them cover urgent expenses, avoiding the stress of waiting for payday and the need for payday advance apps or payday loan solutions.

2. Reduced Financial Stress

By giving workers control over when they receive their wages, EWA reduces financial anxiety. Employees are less likely to experience stress related to bills, emergencies, or other financial challenges. A less stressed employee is more focused, engaged, and productive at work.

3. Improved Budgeting

With access to their wages as they earn them, employees can manage their money more effectively. Instead of facing a situation where they must wait weeks to receive their pay, they can plan better, pay bills on time, and save for the future.

The Link Between Financial Wellness and Employee Retention

The link between financial wellness and employee retention in retail cannot be overstated. Offering financial wellness solutions such as Earned Wage Access can directly impact an employee’s decision to stay with a company. Here’s how:

1. Increased Employee Satisfaction

When employees feel that their financial well-being is being taken seriously, their satisfaction with their job improves. By offering EWA, retailers show that they care about their employees’ needs

beyond just their paycheck. This can lead to increased job satisfaction and a more positive work environment.

2. Reduced Turnover Rates

Employees who have access to their earned wages when they need them are less likely to leave for better-paying jobs. With financial security, workers are more likely to remain with their employer, reducing turnover rates and the associated costs of hiring and training new staff.

3. Enhanced Loyalty

When employees feel supported and empowered to manage their finances, they are more likely to feel loyal to their employer. Loyalty leads to better work performance, a stronger team dynamic, and a more engaged workforce overall.

4. Attracting Talent

In the competitive retail landscape, offering innovative benefits such as EWA can set a retailer apart from others. Candidates are more likely to be attracted to companies that prioritize their employees’ financial well-being, making EWA a powerful tool for attracting top talent.

The Business Case for Financial Wellness Programs

The benefits of implementing a financial wellness program go beyond employee satisfaction and retention— they directly impact the business’s bottom line. By offering solutions like Earned Wage Access, retailers can see:

- Improved Employee Engagement: Financially stable employees are more engaged and invested in their work, leading to better performance and customer satisfaction.

- Cost Savings on Recruitment and Training: With lower turnover rates, retailers save on the expenses related to hiring and training new employees.

- Enhanced Brand Reputation: Companies known for supporting their employees’ financial wellness earn a positive reputation, attracting both customers and potential hires.

- Increased Productivity: Financially secure employees are less distracted by personal financial issues, leading to increased productivity on the job.

Success Stories in the Retail Industry

Numerous retailers have already seen the positive impact of offering Earned Wage Access. For example, a popular retail chain in North America introduced EWA for its employees and noticed a significant improvement in retention rates and employee satisfaction. In the first quarter after implementing EWA, the company reported:

- 18% decrease in turnover rates, as employees felt more financially secure and valued by their employer.

- 25% improvement in customer service scores, as employees were more engaged and motivated to provide exceptional service.

- 15% reduction in absenteeism, as workers were better able to manage personal financial challenges without missing work.

These success stories demonstrate that investing in financial wellness not only improves the lives of employees but also has a direct impact on business performance.

Conclusion: The Future of Employee Retention in Retail

The retail industry is evolving, and so are the ways in which employers support their workforce. Financial wellness programs, particularly Earned Wage Access, are playing a pivotal role in improving employee retention, satisfaction, and overall performance.

By offering financial solutions that give employees control over their wages, retailers can create a more loyal, engaged, and productive workforce. In an industry plagued by high turnover rates, EWA provides a simple yet effective way to keep employees happy, reduce recruitment costs, and boost the business’s bottom line.

As the retail industry continues to face challenges related to employee retention, it’s clear that financial wellness is no longer just a nice-to-have—it’s a must-have. Retailers who embrace this shift will not only retain top talent but also foster a more resilient, productive workforce.