Workplace finances can turn out to be distressing for a lot of employees, as some have fights with their creditors or simply are unable to pay their bills. Many even rely on payday loans, which can become a financial burden. This reduces their contentment and overall concentration. Luckily, services like Earned Wage Access allow employees to get a share of their worked month’s wage during the month. Workers have more control over the way they manage their finances, which lowers their stress levels. Most of the time when a worker has financial problems, he ends up taking on an additional load at his workplace. These loans can be exorbitant, and subsequently, many people who are paid every week or biweekly end up having to take them when they are to pay for extending costs. Workers with Early wage access have much easier ways out, as when they need cash, they can access their earnings well ahead of payday. This enables them to deal with pressure from high expectations, even more so when they have cash to settle upfront. Given this, targets such as getting rid of stress or productivity improvement can be achieved easily with EWA.

Helping Workers with Money Problems

Money stress at work is a big problem for workers. Worrying about bills and sudden costs makes it hard to focus. This can lead to missing work or doing less. Early wage access helps workers by giving them access to their earned wages early. They can use this money to pay bills or handle emergencies without borrowing from payday loans. This reduces stress, helps them feel better, and allows them to focus more at work. Employers benefit when workers are less distracted.

Keeping Workers and Hiring New Ones

Losing workers is expensive for companies. It takes a lot of time and money to find and train new people. Workers stay with companies longer when they feel supported. Offering salary advances shows workers that their employer cares about their needs. It also makes the company more attractive to new hires.

Workers value benefits like employee financial wellness programs, which can give them financial security.

This helps employers keep good workers and attract skilled employees to join their teams.

Better Work and Focus

Workers who worry about money often make mistakes and work slower. When they feel secure about their finances, they can focus better on their jobs. Payday advance apps provide workers with early access to their wages, which helps them handle expenses and avoid stress. This makes them more productive and less likely to be distracted. Employers benefit because workers complete tasks on time and improve the quality of their work. HariGaji ensures workers can perform at their best every day.

Teaching Workers About Money

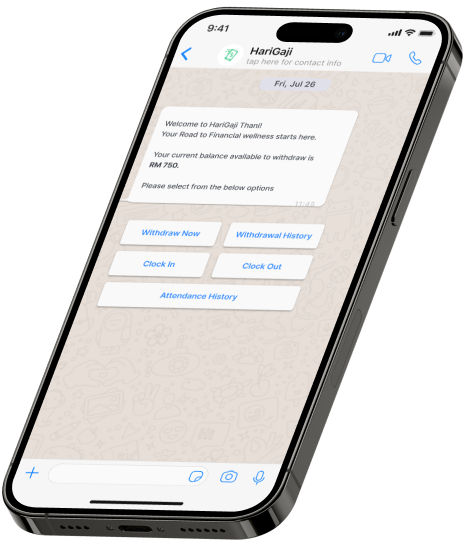

EWA is more than just early pay. It teaches workers how to manage their finances better. Many employee financial wellness programs include tools to help workers save and budget. Workers can learn to plan their expenses and avoid money problems. Some programs also encourage savings by letting workers set aside part of their wages early. This helps workers build financial security for the future. Employers offeringpayday advance apps promote good financial habits, making their workers more stable and responsible.

Avoiding Expensive Loans

Many workers rely on payday loans during emergencies, but these loans have high fees and interest rates. They can lead to serious debt problems. Salary advance helps workers avoid these loans by giving them access to their earned money without borrowing. This allows them to cover bills and sudden expenses without falling into a debt trap. Workers stay financially stable, and employers benefit from having less stressed employees. Instant wage access is a safer and more reliable way to handle money.

Making the Company Look Good

A company’s reputation is important for attracting and keeping workers. Offering early wage access shows that the company cares about its employees’ well-being. Workers who feel supported are more likely to talk positively about their employer. This improves the company’s image and helps attract new talent. HariGaji creates a workplace where workers feel valued and treated fairly. Companies that offer such benefits build a strong reputation and become known as great places to work.

Easy and Affordable Setup

Some employers worry that payday advance apps are costly, but they’re affordable for most companies. Many programs require little to no cost for the employer. Workers only pay small fees when they use the service. Companies save money in the long run by retaining workers and reducing turnover. Instant wage access also improves productivity, which boosts overall business performance. It’s a simple, cost-effective way to help employees and create a better workplace environment for everyone.

Meeting Worker Needs Today

Today’s workforce values flexibility and financial support. Younger workers, especially millennials and Gen Z, expect their employers to understand their needs. Offering a salary advance shows that a company listens and cares about its workers. It gives employees a sense of security and trust in their employer. Companies that provide benefits like employee financial wellness stand out in the competitive job market. Workers feel valued, which improves loyalty and satisfaction. Payday advance apps help businesses stay modern and meet worker expectations effectively.

Conclusion

Earned Wage Access is a financial service that assists employees in settling unforeseen bills up until payday, thus eliminating the need for loans with exorbitant interest or worrying about missed payments. The use of early wage access enhances concentration levels, which boosts the performance of the employee from the employer’s perspective. In return, this cultivates stronger bonds with the employees as well as establishes higher productivity levels and benefits the overall brand image of the company. With how the modern world operates, giving workers salary advances displays how invested a company is in their employees’ well-being. This service is economical and acts as an advantage to both employees and the business, as they are not overworked. Instant wage access fosters trust as well as a healthy and safe environment for employees to accomplish their jobs and meet the company’s expectations together. A company that introduces payday advance apps is both appealing and modern, as it has foresight on how the market operates and looks for the best interests of the employees.