By 2025, due to the implementation of new technologies, the expectations of employees are transforming, and we can see that a revolution is happening among employee benefits plans. One such revolution is earned wage access. Earned wage access (EWA) grants workers access to part of the earnings they have accumulated before the scheduled payment date, thus facilitating financial relief and ensuring completeness. This revolutionary tool is changing the norms of the conventional payment cycles and altering the parameters of employee contentment and retention. In this blog, we’ll discuss how earned wage access as a tool will be critical in showering employees with benefits in the years to come, its benefits, the concerns it addresses, and its relevance in the present-day scenario.

Understanding Earned Wage Access (EWA)

Earned Wage Access (EWA) is a financial service that allows employees to receive a portion of their earned wages before the official payday. This system provides workers with timely access to their money, helping them manage unexpected expenses without waiting for the traditional pay cycle. On-demand pay solutions like EWA contribute significantly to financial wellness and employee financial well-being.

History of EWA

In the early years of the decade in 2010, the concept of earned wage access came into the limelight as an alternative to the more traditional payday loans, which tend to charge exorbitant fees and rates. The fintech companies took note of this and sought a solution that was more sustainable and employee-centered. Starting in 2015, there was a noticeable popularity of EWA platforms in sectors that had high employment of hourly paid employees, such as retail, mechanics, and hospitality. EWB set out to eliminate the need for payday loans by allowing its employees to withdraw their wages at the time they required. This shift towards salary advance options was a key component in enhancing employee financial well-being.

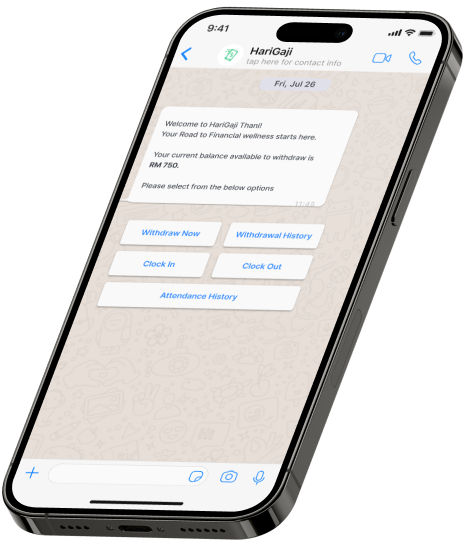

How EWA Works

EWA functions in the form of websites or mobile applications, which are connected to the payroll of an organization. Employees are provided with the ability to see the money that they have already made by a specific date and can place an order against their earnings. Once the request has been placed, the wage is deposited in the employees’ bank account or onto a prepaid card. On the date when the payments are made, the amount that was advanced on the payment is subtracted from the salary. These payroll solutions offer a seamless way to manage on-demand pay and salary advances. Benefits of EWA

There is a reduction in financial stress and high debt interest that is in favor of the employees in an organization; hence there is an increase in job satisfaction and productivity. For employers, earned wage access is likely to increase retention of employees and reduce turnover costs, leading to a more motivated and loyal workforce. As employees’ financial wellbeing is a concern, EWA is invaluable in promoting their health and stability. By integrating EWA into their employee retention strategies, companies can enhance financial wellness among their staff.

Benefits of EWA for Employees

Motivational and Maintenance Stability

EWA has allowed employees to have more management over their finances. A lot of employees are living paycheck to paycheck, which makes it challenging for them when they come across unforeseen costs like a hospital bill or a broken-down car. EWA allows users to lend money whenever they want, and this removes the issue of late payments, overdrafts, or even predatory loans, thus supporting their financial wellness.

Eliminated Commerce Woes

One of the major reasons why people are unable to focus on work due to a barrage of thought is rather stressful finances. Earned wage access aims to cut this burden by allowing quicker access to funds. Moreover, allowing employees to have a sense of feeling secure financially allows them to have a greater focus at work instead of worrying about finances, thereby enhancing their employee financial well-being.

Facilitated Self-rule and Authority

EWA has given employees total self-rule regarding deciding how and when to draw their earnings. This newfound independence improves their spirits and aids in creating a good bond with employers, which is crucial for effective employee retention strategies.

Benefits of EWA for Employers

Improved Employee Retention

Attraction and retention of employees exist as a challenge for businesses due to a high turnover, which is cost-efficient. EWA increases the level of satisfaction and enhances their willingness to remain loyal to the organization. Simply put, people are likely to work for a company that considers their financial needs as part of its employee retention strategies.

Enhanced Recruitment Efforts

Building a brand and differentiating it is important, especially in the current competitive job market, and being quick with their earnings via EWA is a great perk for employees that does just that. Younger workers, in particular, like the choice of being paid more quickly, and therefore a firm looking to recruit the best needs to offer greater flexibility around salary payment dates as part of its payroll solutions.

Increased Productivity

EWA has the power to reduce such pressure, thus improving the overall performance and working efficiency of the employee, but more importantly, by being given the option of free access to earned wages, employees can deal with such anxieties properly as well as reduce their financial burden, contributing to overall financial wellness.

Cost Savings on Payroll Advances

It is self-explanatory that managing payroll the traditional way can sometimes be more of a headache, especially due to time constraints and cost factors. EWA takes away such headaches for businesses by simplifying the process and therefore reducing the costs associated with payroll solutions.

Problems Solved by EWA Breaking the Paycheck-to-Paycheck Cycle

Living paycheck-to-paycheck is a norm for many employees, but earned wage access seeks to alleviate this problem by extending access to ready-earned money, which covers basic requirements and averts employees from getting into debt circumstances, thus improving their financial wellness.

Reducing Dependence on High-Interest Loans

High-interest options like payday loans and other borrowing methods are usually very costly; EWA quotes a more cost-effective option, ensuring avoidance of debt spirals required for survival. This contributes to the employee’s financial well-being.

Addressing Emergency Expenses

Such is life that we never know what lies ahead; with the help of EWA, employees feel safe that they will have access to money covering emergency expenses and can rest easy during difficult times, enhancing their overall financial wellness.

Real-Life Examples of EWA Success

Case Study 1: Retail Industry

We were informed by a premier merchandiser that an EWA implementation allowed for dealing with high employee turnover and unsatisfactory attendance. Within six months of implementation, churn rates stayed 25 percent lower than before, and employee satisfaction is said to have improved as part of their employee retention strategies.

Case Study 2: Healthcare Sector

An EWA implementation was said to be beneficial for healthcare staff dealing with irregular costs. The outcome was an increased level of employee engagement as well as reduced levels of absenteeism, contributing to the organization’s overall employee financial well-being.

Case Study 3: Hospitality Business

We learned that a chain of hotels supplemented their recruitment campaigns with EWA targeting seasonal workers. This encouraged employee retention, which resulted in improving the quality of service, aligning with their employee retention strategies.

The Road Ahead: EWA in 2025 and Beyond

Earned Wage Access is not merely a new concept; it is a game changer in how workers shall be compensated. EWA is likely to become a standard component within an employee remuneration package as more businesses incorporate this benefit. It must be noted that it helps to overcome some financial obstacles while improving contentment and retention; it is beneficial for both employees and employers. Integrating EWA as part of comprehensive payroll solutions and employee retention strategies is expected to enhance overall financialwellness among employees.

In 2025, businesses that readily adopt the EWA model, like Malsiya, will emerge as progressive employers who place a premium on their employees’ welfare. This model is an exemplary innovation in redefining the work environment, underscoring the fundamental inevitability of financial freedom, contributing to employees’ financial wellness.