We started HariGaji with a mission to help the people of Malaysia understand financial wellness and how they can achieve it within their existing means. As a country with a workforce of several hundred million, Malaysia is an untapped, prime market for developing innovative financial products.

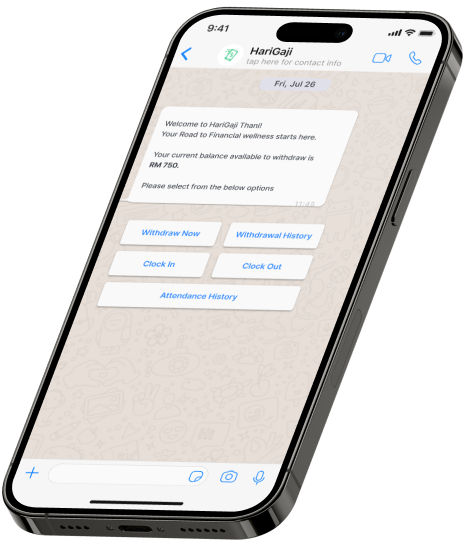

A nation is only as great as its people, and people are at their best when they’re happy and lead stress-free lives. Personal finance stability and mental health go hand-in-hand, and both topics have not received due attention in our education curriculum. Therefore, we took the initiative to create HariGaji, a platform that helps people improve their financial health by simplifying how they see, spend, send and save their money – all of this on their smartphone.

We want people to know how much money they have earned at any point of their workday, retrieve it when necessary and make informed decisions. We believe this access is their right.

HariGaji provides people a powerful yet simple tool to learn about their spending patterns, budgets, and their scope to save and invest. HariGaji’s platform puts people in the driving seat to control their finances by avoiding speed bumps like high-interest payday loans, costly microlenders and exploitative credit schemes.

Our goal is simple – financial inclusivity for everyone in Malaysia.